116

African startups raised US$3.9 billion throughout 506 offers in 2025, reflecting a stabilising enterprise capital market, in line with the African Personal Fairness and Enterprise Capital Affiliation (AVCA).

The 2025 Enterprise Capital Exercise in Africa report reveals that whereas funding stays under earlier peaks, deal exercise has steadied. Early-stage investments, elevated participation by home traders, and the speedy progress of enterprise debt outlined the 12 months.

Africa’s enterprise ecosystem entered 2025 in a section of disciplined adjustment, with deal quantity rising by 4 p.c year-on-year. The continent stood out globally as the one area the place enterprise exercise didn’t decline throughout the interval.

Seed and early-stage segments confirmed notable resilience, with median deal sizes reaching multi-year highs. This pattern displays stronger investor conviction on the entry degree regardless of a extra selective funding atmosphere.

The report additionally highlights shorter fundraising timelines between Seed and Sequence A rounds, pointing to improved effectivity in early-stage progress.

On the higher finish of the market, eight megadeals had been recorded in 2025, elevating a mixed US$1.3 billion. These massive transactions helped offset a slowdown in late-stage fairness funding, which dropped to its lowest degree since 2020.

One of the crucial important developments throughout the 12 months was the enlargement of enterprise debt as a financing device. Enterprise debt reached US$1.8 billion, practically doubling in comparison with the earlier 12 months and persevering with a three-year progress pattern.

Debt financing is more and more changing into a core element of startup funding methods, significantly amongst growth-stage firms searching for to increase their runway, minimise fairness dilution, and enhance capital effectivity.

This shift aligns Africa’s funding dynamics extra intently with extra mature rising markets. East Africa accounted for greater than two-thirds of regional enterprise debt deal worth, underlining its rising significance within the ecosystem.

Enterprise-backed exits rose to a document 34 in 2025, marking a 31 p.c enhance year-on-year and outpacing world progress, which stood at simply 1 p.c.

North Africa led within the variety of exits, whereas Southern Africa recorded the best exit worth at US$288 million.

Commerce gross sales remained the dominant exit route, accounting for over 70 p.c of each quantity and worth. Nonetheless, the report notes a gradual diversification of exit channels, with monetary sponsors rising their participation, significantly in mature sectors similar to fintech.

Africa-based patrons accounted for 54 p.c of exits, highlighting the rising function of native and regional acquirers alongside worldwide traders.

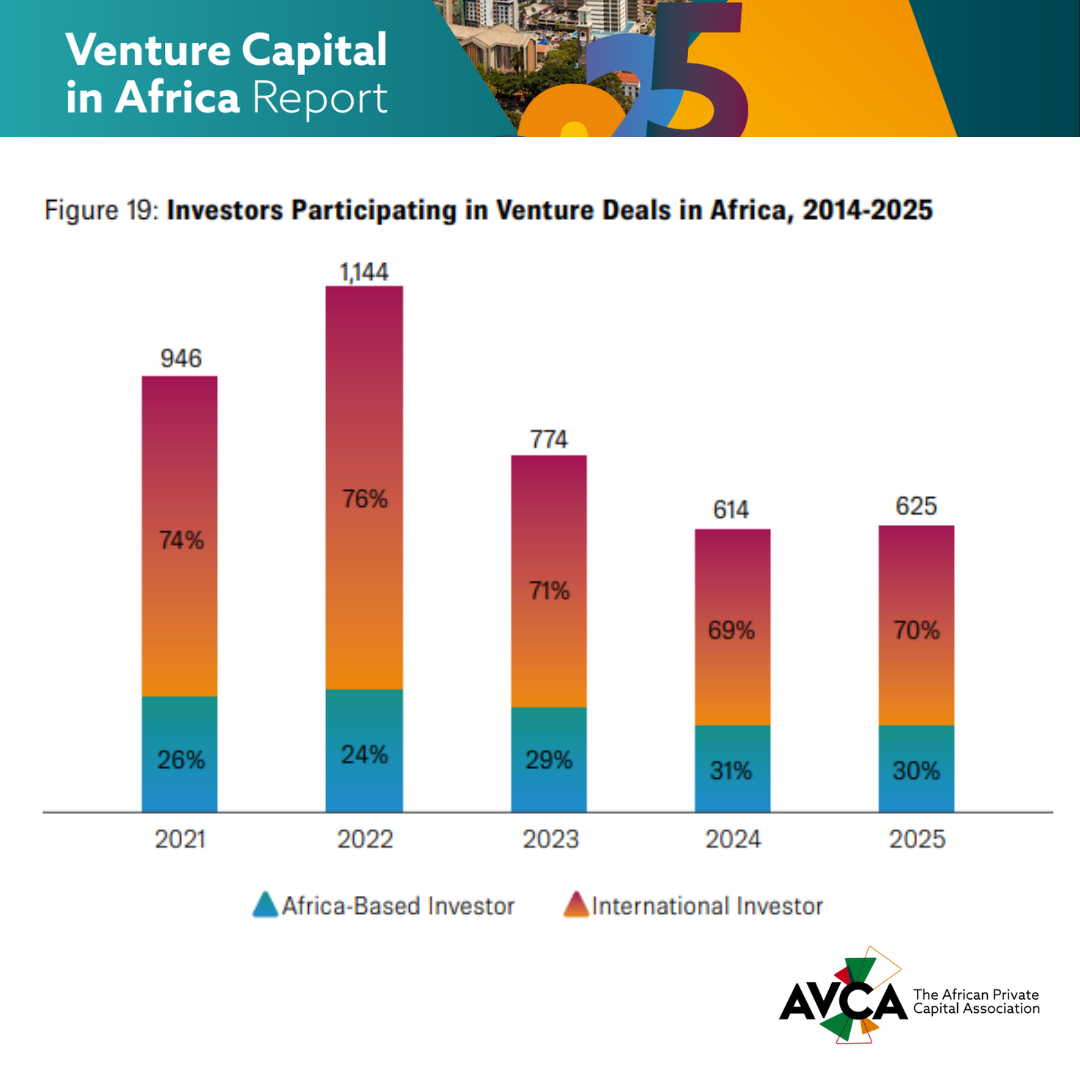

Home capital performed a extra outstanding function in 2025, with African traders accounting for 45 p.c of complete enterprise fund commitments, up from a mean of 23 p.c between 2022 and 2024.

This progress was largely pushed by corporates and African growth finance establishments (DFIs). Though total DFI participation declined to 27 p.c, the composition shifted considerably, with African DFIs contributing 63 p.c of deployed capital.

The pattern factors to a extra domestically anchored funding ecosystem, lowering reliance on exterior capital flows and world market sentiment.

Commenting on the findings, Abi Mustapha-Maduakor, Chief Government Officer of AVCA, mentioned the sector is coming into a extra sustainable section.

“The African enterprise capital ecosystem is recalibrating in the direction of affected person, structured and domestically anchored capital. The record-breaking home participation and exit exercise we see reveals that African traders are more and more assured in backing homegrown companies and reaching exits, offering robust validation of the ecosystem’s long-term investability,” she mentioned.

She added that the following precedence is to broaden the capital base to make sure that traders supporting high-growth startups throughout the continent can entry sufficient funding.