Cisco Systems Inc. (NASDAQ: CSCO) this week reported better-than-expected fourth-quarter revenue and earnings, aided by strong demand for its AI-powered products and solutions. However, the stock dropped soon after the announcement on Wednesday, but regained momentum during after-hours trading.

Last week, Cisco’s stock climbed to an all-time high, extending its recovery from the April lows. The value has grown more than 50% in the past twelve months. The market is bullish on CSCO’s prospects, as the company appears well-positioned to tap into the massive opportunity in AI infrastructure. It has been actively innovating lately, integrating advanced security into networking products while ensuring operational simplicity for customers.

Results Beat

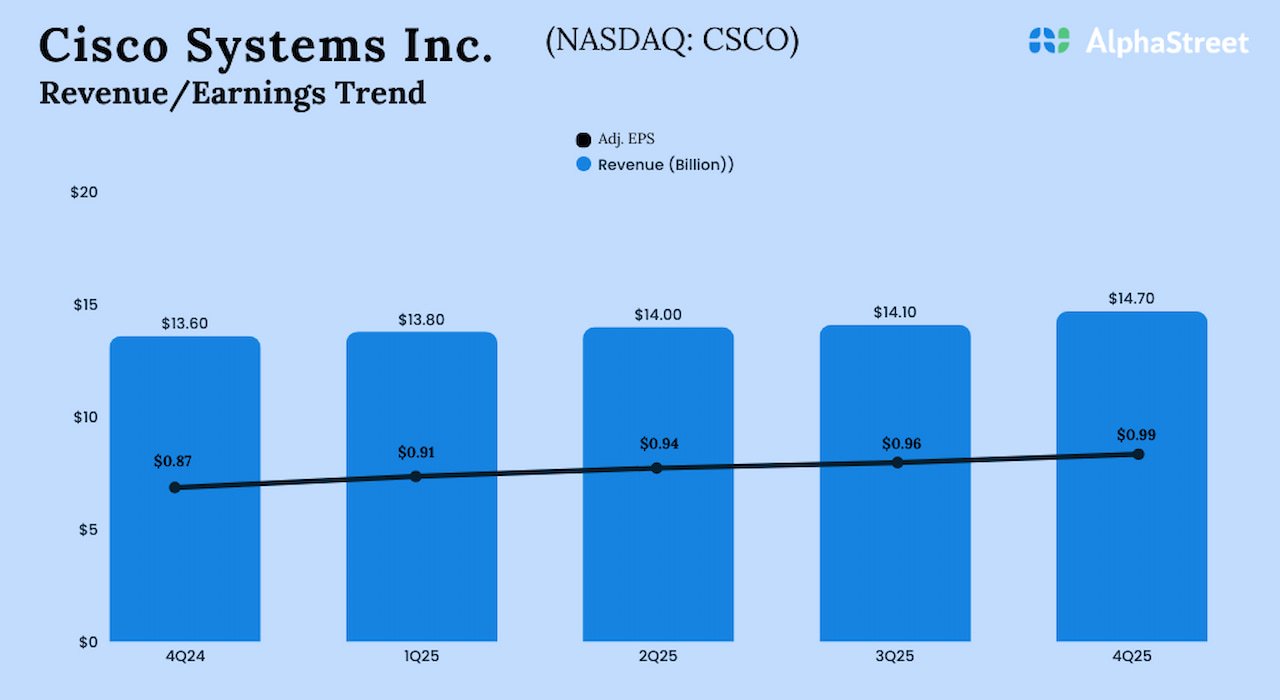

The San Jose-headquartered network gear maker’s adjusted earnings rose to $0.99 per share in the fourth quarter from $0.87 per share in the same period last year, exceeding estimates. On an unadjusted basis, net income was $2.8 billion or $0.71 per share in Q4, compared to $2.2 billion or $0.54 per share in the same period of fiscal 2024. Q4 revenue increased to $14.7 billion from $13.64 billion in the prior-year quarter.

The growth reflects an increase in orders across markets, demonstrating robust demand for Cisco’s products. In FY25, AI infrastructure orders from web-scale customers were more than double the management’s original target. For the first quarter of FY26, it expects revenue to be in the range of $14.65 billion to $14.85 billion. The forecast for Q1 adjusted earnings per share is $0.97-$0.99. In Q4, Cisco returned $2.9 billion in capital to shareholders through share repurchases and dividends as it maintains profitable growth and continues to produce strong cash flows.

Outlook

For the whole of fiscal 2026, the management forecasts revenue in the range of $59.0 billion to $60.0 billion, and adjusted earnings per share in the $4.00-4.06 range. The company said it is building infrastructure needed for the AI era as it sees a significant opportunity in that area. Cisco’s AI strategy focuses on meeting the high demand in AI training infrastructure for webscale customers, AI inference and enterprise clouds, and AI network connectivity.

From Cisco’s Q4 2025 earnings call:

“All of our new innovations introduced in FY 25, spanning core networking products based on Cisco Silicon One, advanced security technologies, and unified management tools are designed on the foundation of AI further enhancing Cisco’s platform advantage, where every technology doesn’t just add value by itself, but compounds the value of our customers’ existing investments. We continue to use GenAI and Agentic systems across our customer experience organization with things like services as code and AI agents for in-product support, renewals, and adoption.”

The company’s shares traded lower on Thursday afternoon, after opening at $65.05. The average price of the stock for the last 52 weeks is $59.91.