Alibaba Group Holding Limited (NYSE: BABA) is navigating a complex landscape marked by restructuring efforts, AI-driven growth, and lingering fallout from the Ant Group settlement. As competitive pressures intensify across the company’s core e-commerce platforms, investor attention is shifting to Alibaba Cloud, which has posted robust growth in recent quarters, fueled by surging demand for AI infrastructure and enterprise solutions.

The China-based tech firm, one of the early movers in AI computing, is actively investing to expand its capabilities in that area. Alibaba is all set to publish its first-quarter 2026 earnings on Friday, August 29, at 5:35 am ET. It is estimated that Q1 earnings, excluding special items, declined to ¥15.47 (CNY) ADS from ¥16.44 (CNY) ADS in the corresponding quarter of FY25. Analysts forecast revenues of ¥253.81 (CNY) billion for the June quarter. In the prior-year quarter, the company’s revenues were ¥243.24 (CNY) billion.

At the Bourses

Alibaba’s stock remains significantly below its COVID-era peak, although it has gained about 47% over the past 12 months. After showing early momentum in 2025, the shares have largely moved sideways, reflecting investor caution amid mixed macro signals and internal restructuring efforts. The stock posted strong gains on Friday, in line with broader strength across US-listed Chinese tech firms.

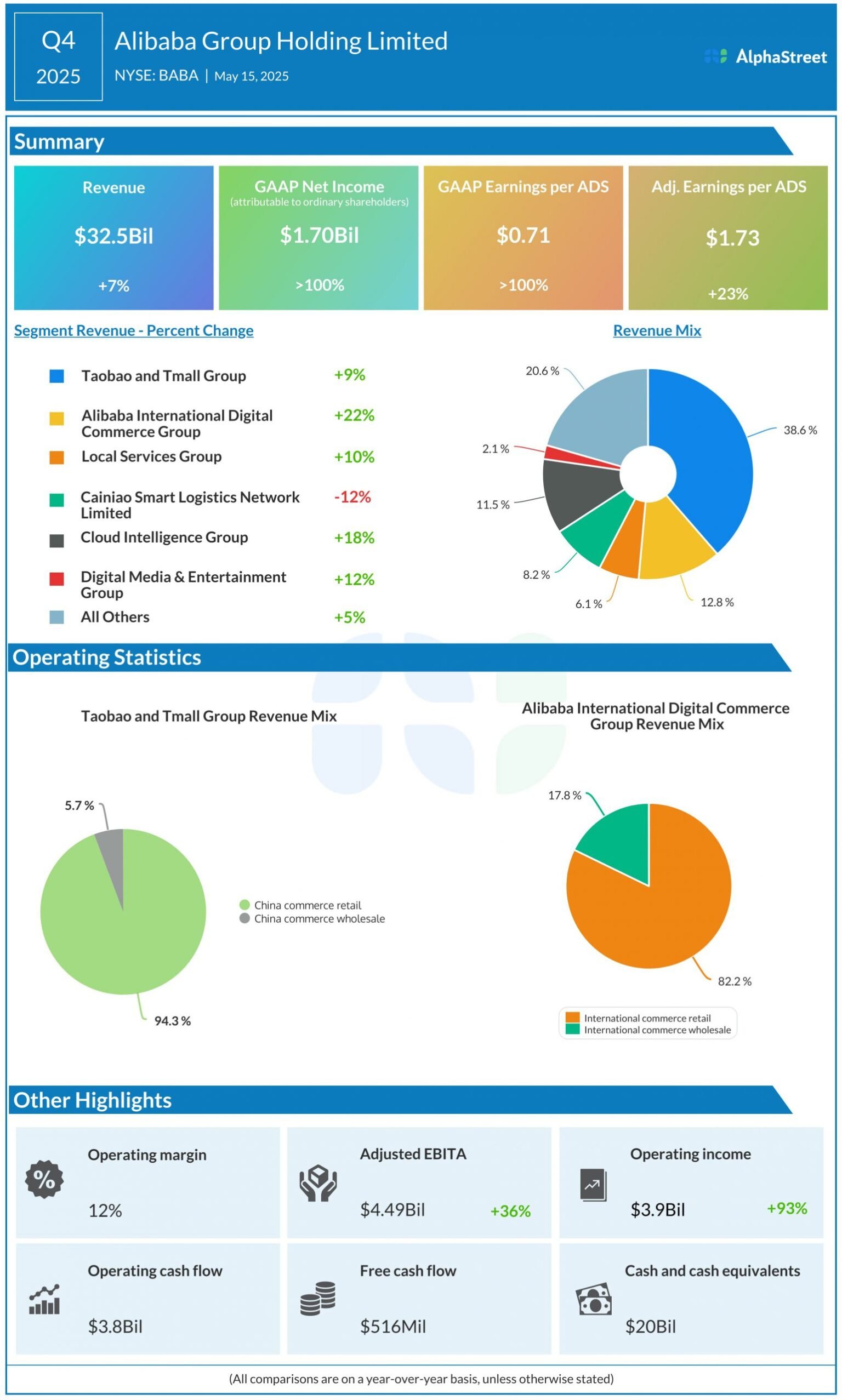

In the fourth quarter of fiscal 2025, revenues increased 7% annually to $32.5 billion. Revenue grew across all key operating segments. Consequently, Q4 earnings, adjusted for special items, climbed 23% year-over-year to $1.73 per ADS. On a reported basis, net income attributable to the company’s shareholders was $1.70 billion or $0.71 per ADS. During the quarter, Alibaba repurchased 51 million ordinary shares for a total of $0.6 billion. Both revenue and the bottom line missed expectations, after beating in the previous quarter.

From Alibaba’s Q4 2025 earnings call:

“We continue to see growing demand for cloud and AI, an opportunity that will define the next 10 to 20 years. And will not be derailed by short-term supply chain fluctuations. Our confidence and commitment to investing in cloud and AI infrastructure remain unchanged, and we are actively exploring diversified solutions to meet rising customer demand. We continue to advance foundational research and innovation in large models, pushing the boundaries of model capabilities while remaining firmly committed to open source.”

New Vistas

Alibaba recently revealed plans to introduce its own AI-powered glasses, putting the company in direct competition with glasses offered by Meta in collaboration with Ray-Ban and Oakley. The company is working on an extensive restructuring plan announced earlier — to split the business into six independent units, aiming to streamline operations and enhance agility. Last year, Alibaba agreed to a $433.5 million settlement to resolve a dispute with investors over the botched IPO of its fintech affiliate Ant Group.

On Friday, Alibaba’s stock traded higher throughout the session, after opening at $120.47. The average price of the stock for the last 52 weeks is $108.16.