Shares of eBay Inc. (NASDAQ: EBAY) stayed red on Tuesday. The stock has gained 16% over the past three months. The ecommerce giant is set to report its earnings results for the second quarter of 2025 on Wednesday, July 30, after market close. Here’s a look at what to expect from the earnings report:

Revenue

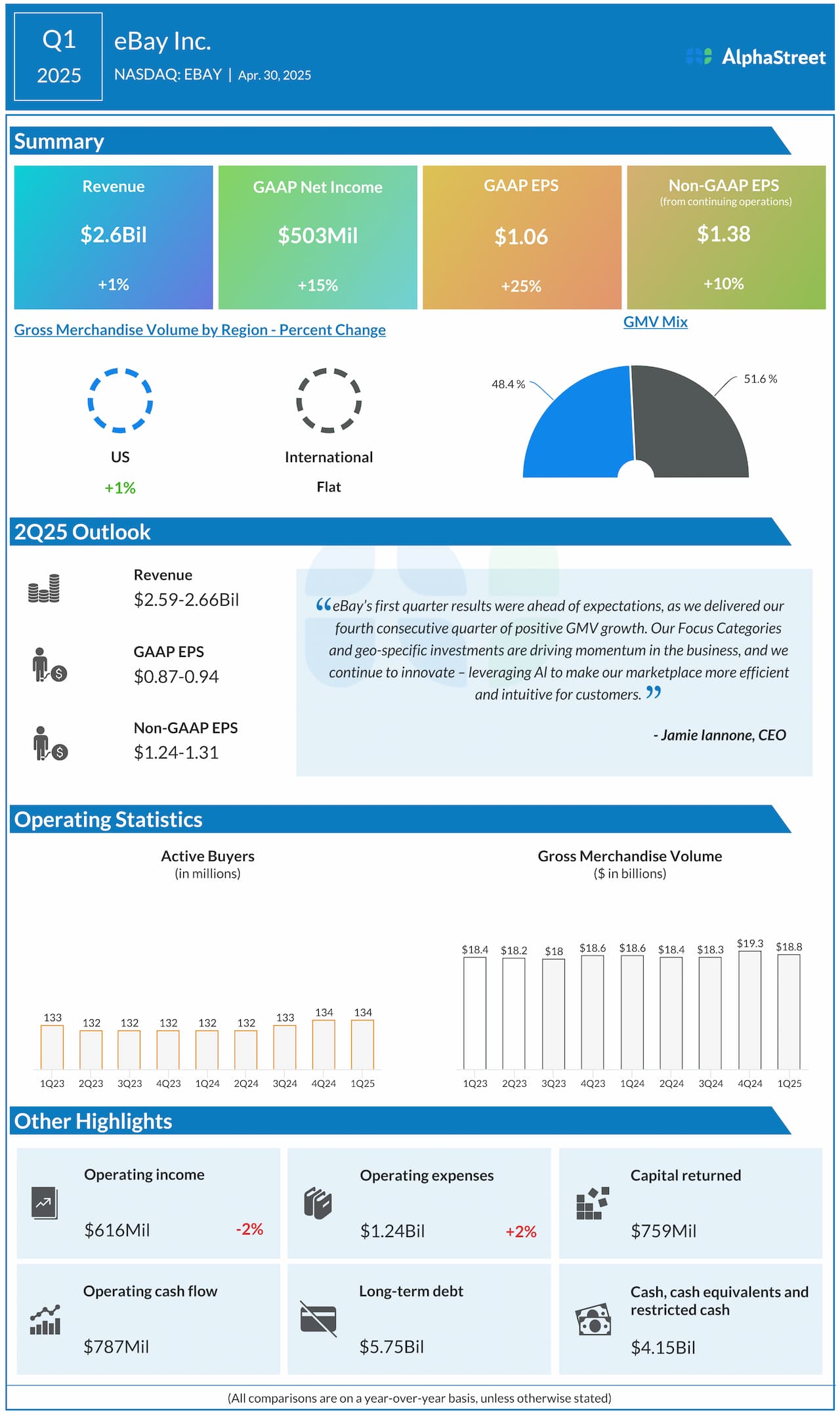

eBay has guided for revenue of $2.59-2.66 billion for the second quarter of 2025. Analysts are projecting revenue of $2.64 billion. This compares to revenue of $2.57 billion reported in the second quarter of 2024. In the first quarter of 2025, revenue inched up 1% year-over-year to $2.58 billion.

Earnings

EBAY has guided for GAAP earnings per share of $0.87-0.94 and adjusted EPS of $1.24-1.31 for Q2 2025. Analysts are predicting EPS of $1.30. This compares to adjusted EPS of $1.18 reported in Q2 2024. In Q1 2025, adjusted EPS grew 10% YoY to $1.38.

Points to note

eBay has guided for gross merchandise volume (GMV) of $18.6-19.1 billion for the second quarter of 2025, which represents FX-neutral YoY growth of down 1% to up 2%. In Q1 2025, GMV was $18.8 billion, up 2% on an FX-neutral basis.

eBay can be expected to benefit from momentum in its focus categories, particularly collectibles, fashion, and luxury. Last quarter, GMV from focus categories grew 6%, led by collectibles, especially trading cards. The company can be expected to benefit from demand for refurbished and pre-owned goods especially in times when consumers continue to seek value.

eBay’s region-specific investments are also likely to have benefited the Q2 performance. The company’s initiatives in simplifying shipping as well as the addition of pick-up and drop-off capabilities in the UK are likely to have yielded benefits during the second quarter.