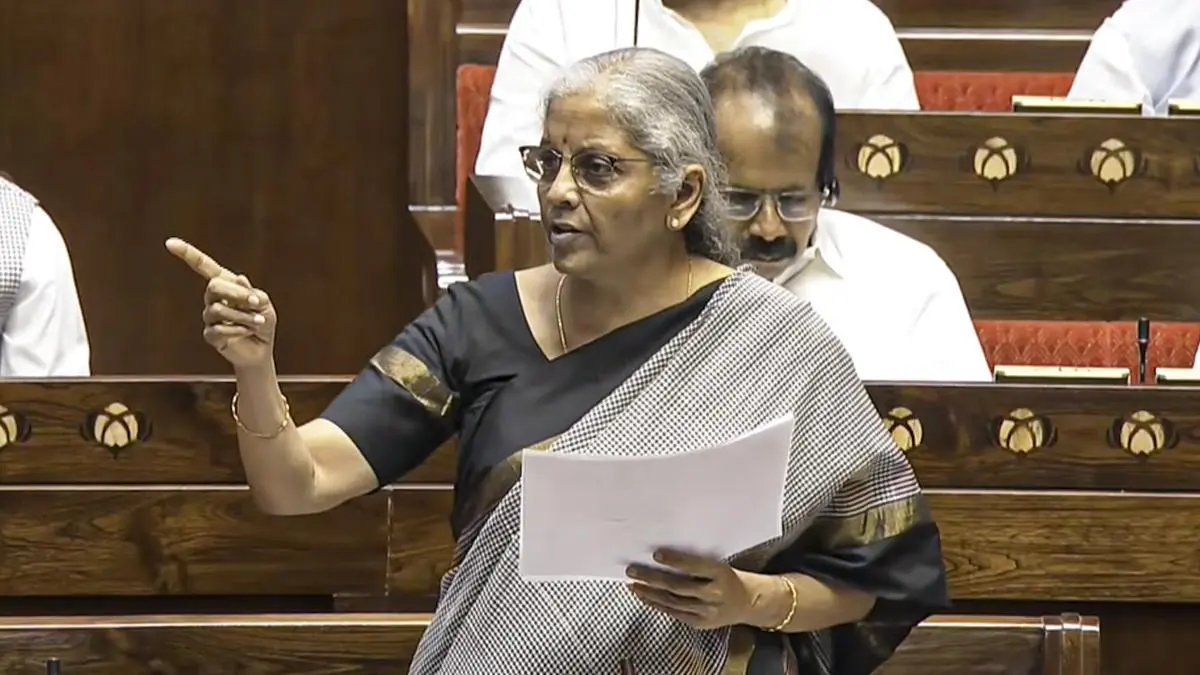

Finance Minister Nirmala Sitharaman

The Finance Ministry has proposed to erase provisions related to the condition of Indian residents holding majority of directors and key managerial positions in insurance companies with foreign investment.

Draft for Changes in Indian Insurance Companies (Foreign Investment) Rules, 2015, is being considered as a precursor for amending the law of 100 per cent foreign direct investment (FDI). However, a senior government official told businessline, “Once the draft is converted into final rules, it will be applicable for existing companies as well.”

As on date, FDI of up to 74 per cent is permitted in the insurance sector. Finance Minister Nirmala Sitharaman, in her Budget speech for FY26, proposed 100 per cent FDI for the sector. While the law for amending the cap is still awaited, the official said that the draft for change in rules aims to review the current guardrails and conditionalities, as announced by the minister.

New rules

A provision in the draft proposes to omit clause (a) and (b) along with explanation under sub-rule (1) of rule 4. In the original rule, the sub rules state, “In an Indian insurance company having foreign investment (a) a majority of its directors (b) a majority of its key management persons and (c) at least one among the chairperson of its Board, its managing director and its chief executive officer, shall be resident Indian citizens.” Explanation says the expression ‘Key Management Person’ shall have the same meaning as assigned to it in guidelines made by the Authority on corporate governance for insurers in India. The draft retains on only clause (c).

Additionally, the draft states that in the Rules, all references to Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2000, shall be substituted with Foreign Exchange Management (Non-Debt Instrument) Rules, 2019, and all references to FEMA Regulations, 2000, shall be substituted with FEMA (NDI) Rules. The official said keeping this in mind, all the related sections will be removed. Also, provision related with 74 per cent cap will be substituted with the words “to exceed the limit as stipulated by the Insurance Act,1938”.

Space for more

Commenting on the draft, Sonam Chandwani, Managing Partner at KS Legal & Associates said, “Earlier, the law was restrictive, prescriptive, and heavy on regulatory hand-holding. Now, it is being recalibrated to be permissive, principle based, and regulator verified. The underlying message is that the Indian insurance market is ready to absorb greater foreign participation under a modernised legal environment.”

Manmeet Kaur, Partner at Karanjawala & Co said the proposed changes will certainly reduce regulatory overhead and streamline investment process while increasing insurance penetration. The cap of 74 per cent equity capital is proposed to be replaced with the ceiling limits provided under the Insurance Act, 1938. “It is likely that there will be further amendments raising the limit to 100 per cent, as proposed in the 2025 Budget, which will bring India in line with other countries that allow 100 per cent FDI,” she said.

Arun Khatri, Managing Partner at K&R Legal, said by removing the explicit FDI cap from the rules and deferring to the Act, the government has eliminated the scope for conflict, duplication, or outdated provisions. This ensures a streamlined legal framework, where a single amendment to the parent law suffices. “Even as the operative ceiling remains at 74 per cent, currently, the draft reflects a deliberate legislative technique to embed flexibility, reduce compliance friction, and establish rule – Act parity in India’s insurance regulation,” he said.

Published on August 31, 2025