Shares of Hasbro, Inc. (NASDAQ: HAS) stayed red on Tuesday. The stock has gained 43% over the past three months. The toy company is scheduled to report its earnings results for the second quarter of 2025 on Wednesday, July 23, before markets open. Here’s a look at what to expect from the earnings report:

Revenue

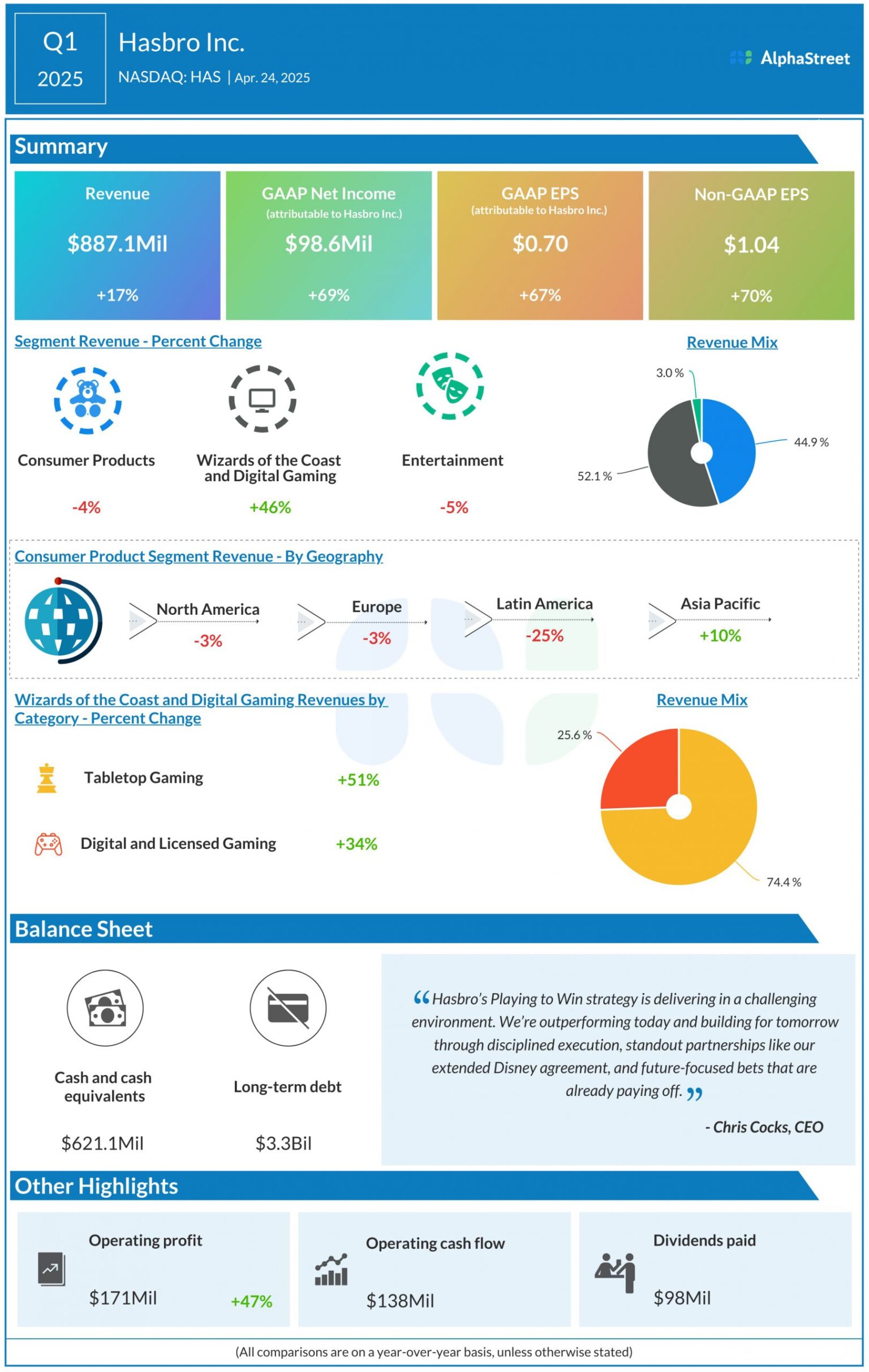

Analysts are projecting revenue of $885 million for Hasbro in the second quarter of 2025, which indicates a decrease of 11% from the same period a year ago. In the first quarter of 2025, revenue increased 17% year-over-year to $887.1 million.

Earnings

The consensus estimate for earnings per share in Q2 2025 is $0.77, which implies a 37% decline from the year-ago quarter. In Q1 2025, adjusted EPS rose 70% YoY to $1.04.

Points to note

Hasbro continues to operate in a dynamic macro environment but its Playing to Win strategy is paying off. The company’s strategic focus on high-growth, high-margin businesses has helped boost top and bottom line growth. Its games portfolio and its licensing business are particular areas of strength.

Last quarter, the Wizards of the Coast and Digital Gaming segment saw double-digit revenue growth, helped by strength in MAGIC: THE GATHERING, digital and licensed gaming and DUNGEONS & DRAGONS. The Consumer Products segment, despite a decline, performed better than expected with growth across brands such as Marvel, Transformers and Monopoly.

Hasbro is also expected to benefit from its partnerships with leading brands across toys and games. The company’s licensing agreement with Disney for Marvel and Star Wars, as well as its agreement with Marvel for MAGIC: THE GATHERING are expected to drive significant benefits.

Hasbro’s cost-saving efforts are expected to yield benefits and help margins. The company is targeting $175-225 million in gross savings for fiscal year 2025.