Shares of Hormel Meals Company (NYSE: HRL) gained over 3% on Thursday. The corporate delivered blended outcomes for the fourth quarter of 2025, as earnings got here forward of expectations whereas income fell brief. The branded meals supplier expects prime line progress within the upcoming fiscal 12 months. The underside line is predicted to stay pressured within the first quarter after which see a restoration thereafter.

Earnings beat, revenues miss

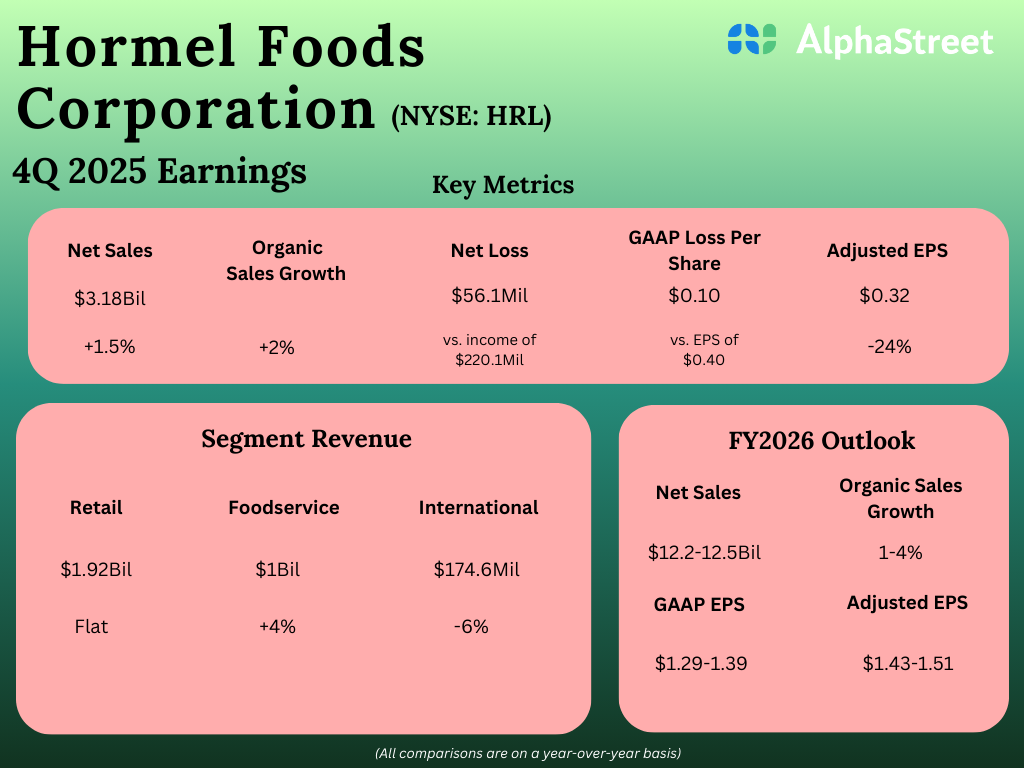

Hormel reported internet gross sales of $3.18 billion for the fourth quarter of 2025, which was up 1.5% from the earlier 12 months however under estimates of $3.24 billion. Natural gross sales grew 2%. On a GAAP foundation, the corporate posted a internet lack of $0.10 per share. On an adjusted foundation, earnings per share fell 24% year-over-year to $0.32, however managed to surpass projections of $0.31.

Model power

In This autumn, Hormel’s prime line benefited from power in its model portfolio whereas its backside line continued to be pressured by persistent enter price inflation in addition to a challenged shopper surroundings.

Throughout the quarter, gross sales within the Retail section grew 1%, pushed by positive factors from the turkey portfolio, and the Planters and Applegate manufacturers. These have been partly offset by the discontinuation of sure personal label snack nuts choices.

In Foodservice, gross sales elevated 4% on a reported foundation and 6% on an natural foundation. Natural gross sales progress was pushed by positive factors from the custom-made options enterprise, branded bacon and pepperoni, premium ready proteins, and the Jennie-O turkey portfolio. This section continues to profit from a variety of merchandise and a various channel presence.

The Worldwide section noticed gross sales decline 6%, as progress in SPAM luncheon meat and the refrigerated portfolio was greater than offset by declines in contemporary pork exports. Whereas the corporate noticed quantity and gross sales progress in China, it skilled aggressive pressures in Brazil throughout This autumn.

Prime and backside line progress subsequent 12 months

For fiscal 12 months 2026, Hormel expects internet gross sales to vary between $12.2-12.5 billion. Natural gross sales are anticipated to develop 1-4%. The corporate expects gross sales progress for all its segments regardless of a pressured shopper surroundings. The Retail section is predicted to see low-single-digit natural gross sales progress for the 12 months. The Foodservice section is predicted to see gross sales progress within the mid-single-digits whereas the Worldwide section is projected to see high-single-digit gross sales progress.

HRL expects to see continued earnings strain within the first quarter of 2026 and a progress in earnings for the rest of the 12 months. The corporate expects GAAP EPS of $1.29-1.39 for FY2026. Adjusted EPS is predicted to vary between $1.43-1.51, representing a progress of 4-10%.