Picture supply: Getty Photographs

At the moment, the State Pension pays £11,502 a 12 months. The apparent query is what dimension ISA it will take to generate the identical earnings independently – successfully doubling retirement earnings for somebody who additionally qualifies for the complete State Pension.

The drawdown maths

As soon as the contribution part of an ISA ends and withdrawals start, the problem turns into easy in concept however difficult in apply: balancing portfolio development with a sustainable earnings.

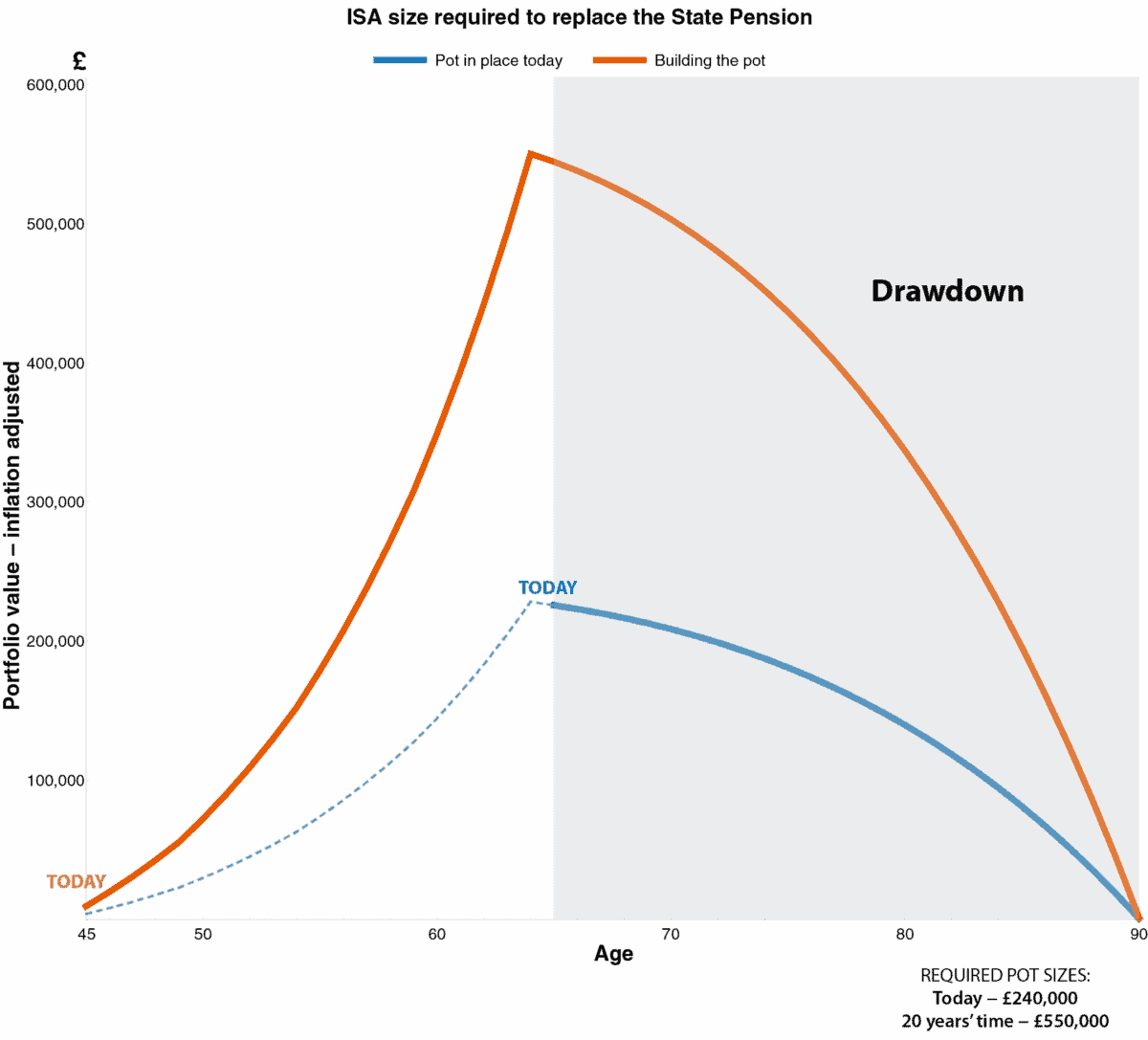

The chart beneath illustrates this. The blue line assumes contributions cease as we speak and a portfolio is already in place. That portfolio helps a State Pension-matched withdrawal yearly till age 90.

I assume the State Pension grows at 4.5% a 12 months, inflation runs at 2%, and the remaining portfolio delivers a conservative 4% annual return. Throughout drawdown, defending capital issues greater than chasing excessive development. Underneath these assumptions, the portfolio required is £240,000.

Chart generated by creator

Future contributions

The image modifications when you’re nonetheless within the accumulation part. For instance, let’s assume an investor is 45 and planning forward.

As a result of the State Pension is assumed to rise by 4.5% a 12 months, its annual worth in 20 years could be near £27,000.

That’s the place the orange line is available in. Because the chart exhibits, just one trajectory helps a pension-matched withdrawal by means of to age 90. On this state of affairs, the required portfolio rises to round £550,000.

Lengthy-term pondering

Reaching a £550,000 portfolio worth inside a 20-year investing time-frame is definitely a problem. However I imagine it’s achievable with a rigorously chosen portfolio of high-growth shares and low-volatility dividend shares.

Within the former class, the vitality transition supplies buyers with a chance for publicity to a pattern that’s nonetheless very a lot in its infancy.

One steel is on the coronary heart of the vitality transition: copper and mining big Glencore (LSE: GLEN) is positioning itself to be one of many greatest copper producers on the planet over the subsequent decade.

The latest merger talks with Rio Tinto spotlight the sturdy place during which the miner’s portfolio places it. Whereas the deal is way from sure, it underscores how invaluable its copper property are considered by its larger peer.

When it studies later this month, copper output shall be within the area of 850,000 tonnes. By 2035, its concentrating on output of 1.6m.

Over the previous 12 months, copper costs have exploded 40%. This isn’t solely all the way down to rising demand but in addition displays extraordinarily tight provide.

Chile is the undisputed king in relation to copper manufacturing accounting for over 1 / 4 of world manufacturing. However new discoveries have gotten more and more tougher to return by and ore grades are in long-term decline.

That mentioned, the latest run-up within the inventory will be immediately attributable to merger talks. Even when an settlement is reached, a merger of this dimension brings with it large dangers. Rio Tinto is a pureplay standard miner, whereas Glencore’s roots are in buying and selling. Marrying such completely different company cultures may doubtlessly end in a bigger price base.

Backside line

There are various methods for buyers to realize publicity to the largest macro themes of the day together with electrification, onshoring and the AI arms race. However for me the best worth as we speak lies not within the applied sciences themselves however upstream: sourcing the important minerals that flip daring ambitions into actuality. That’s why Glencore earns a spot in my ISA portfolio and could possibly be value contemplating.