Johnson & Johnson’s (NYSE: JNJ) business strategy for fiscal 2025 is focused on reducing the impact of patent expirations on its revenue. Anticipating sales to benefit from growth initiatives, including acquisitions and product rollouts, the company has raised its full-year revenue guidance. Meanwhile, the business is under pressure from multiple talc-related lawsuits, with potential liabilities reaching into millions of dollars.

When the healthcare giant reports its second-quarter results on July 16, before the opening bell, Wall Street will be looking for adjusted earnings of $2.68 per share on revenues of $22.86 billion. That compares to earnings of $2.82 per share and revenues of $22.45 billion reported in the prior-year quarter.

Johnson & Johnson’s stock experienced high volatility in the past year, reflecting company-specific challenges like patent expiration of lead products as well as broader market dynamics. While the stock has gained about 8% since the beginning of 2025, the current value nearly matches the levels seen three months ago. In April, the company raised its quarterly dividend by 4.8%, lifting JNJ’s appeal as a compelling long-term investment.

Q1 Outcome

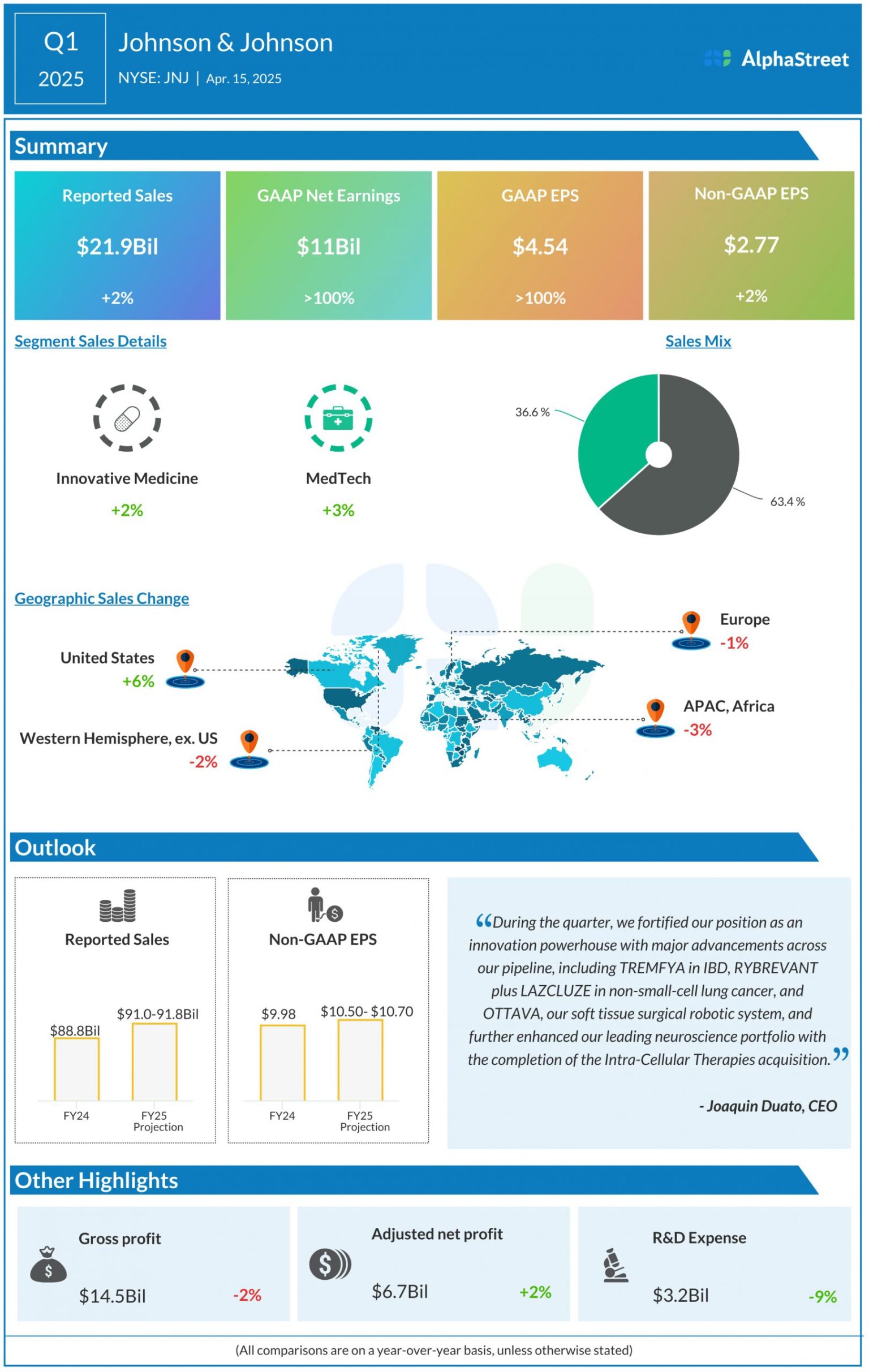

In the first quarter of fiscal 2025, sales increased 2.4% year-over-year to $21.9 billion, with operational sales growing 4.2%. The modest top-line growth translated into a 2.2% rise in adjusted earnings to $2.77 per share. Net income, including special items, moved up to $11 billion or $4.54 per share in Q1 from $3.25 billion or $1.34 per share in the year-ago quarter. Both sales and the bottom line topped expectations, continuing the long-term trend.

Commenting on the company’s aggressive investment strategy, CEO Joaquin Duato said in the Q1 earnings call, “The investment includes four planned new manufacturing facilities, the first of which broke ground last month in North Carolina. And, at the beginning of April, we announced the completion of our acquisition of Intra-Cellular Therapies, which extends Johnson & Johnson’s industry-leading portfolio in central nervous system disorders. With the addition of CAPLYTA, we have expanded our lineup of therapies with at least $5 billion-plus potential in peak year sales, further solidifying sales growth above analyst expectations now through the rest of the decade.”

Going forward, Johnson & Johnson faces potential revenue loss from biosimilar competition to its products including blockbuster drug Stelara, following the expiration of some of its patents this year. Recently, it submitted a supplemental biologics license application to the FDA, seeking approval to expand the use of Stelara for pediatric patients. Earlier, the company revealed plans to invest around $55 billion in the US over the next four years in manufacturing, R&D, and technology.

Expectations

A few months ago, the management raised its full-year 2025 revenue guidance to the range of $91.0 billion to $91.8 billion, which represents a 3% year-over-year increase at the mid-point. The upward revision reflects estimated revenues from Caplyta, a popular antipsychotic drug developed by Intra-Cellular Therapies, which joined the Johnson & Johnson fold this year. The company expects FY25 adjusted earnings to grow around 6% annually to $10.50-10.70 per share.

Johnson & Johnson’s average stock price for the last 52 weeks is $156.36. On Tuesday, the shares opened at $155.27 and made modest gains in early trading.