Video streaming giant Netflix, Inc. (NASDAQ: NFLX) has reported strong Q2 results, with revenue and earnings growing YoY and beating estimates. Anticipating the momentum to extend into the remainder of the year, the company raised its full-year revenue guidance. Still, shares fell after the release, potentially reflecting investor concerns over the management’s cautious views on margin performance.

Netflix’s stock has doubled in less than a year, sparking concerns that it may now be overvalued. Of late, there has been less visibility on subscription trends since the company has stopped reporting user numbers. A couple of weeks ago, the shares climbed to an all-time high of around $1,340, but have lost momentum since then. The average stock price over the past 52 weeks is $921.79.

Strong Q2

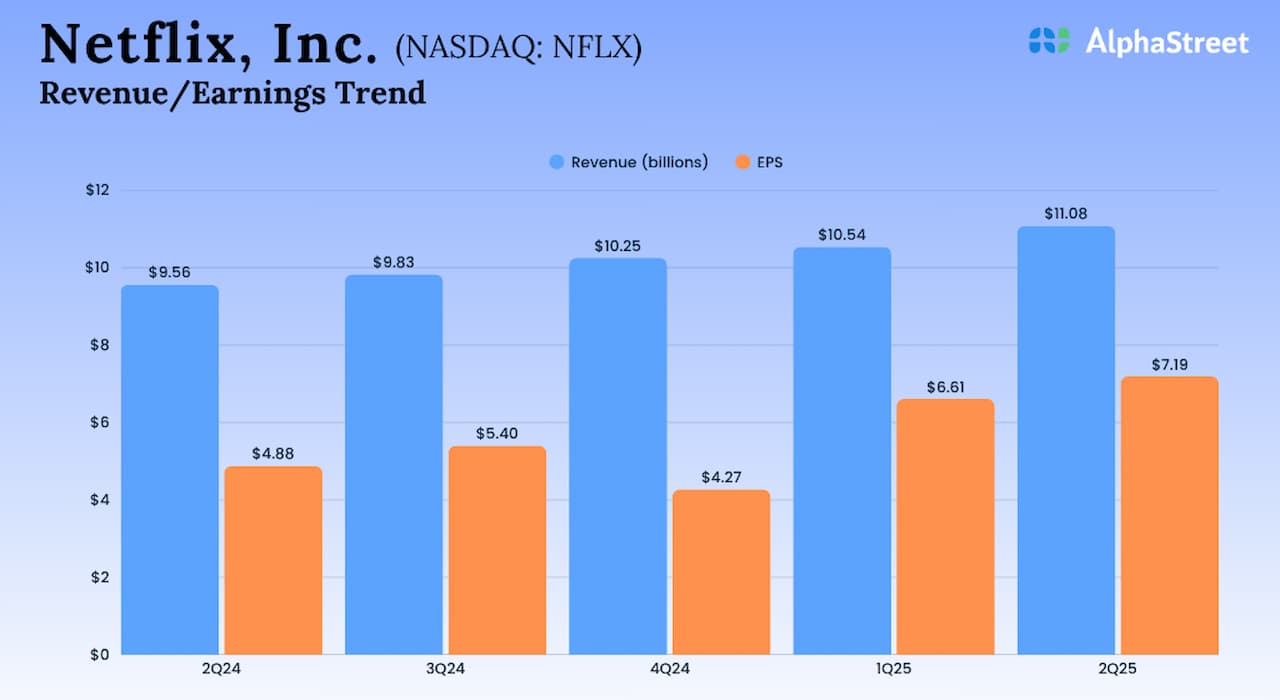

Second-quarter revenue increased about 16% from last year to $11.08 billion, exceeding the market’s expectations. Favorable currency exchange rates and the company’s strong content contributed to the top-line growth. As a result, net income climbed to $3.13 billion or $7.19 per share in Q2 from $2.15 billion or $4.88 per share in the prior-year quarter. Earnings beat estimates, continuing the trend seen in recent years.

Looking ahead, the management expects third quarter revenues to grow 17.3% YoY to $11.53 billion. It is looking for net income of $2.98 billion or $6.87 per share for the September quarter, and an operating margin of 31.5%. However, operating margins are expected to be lower in the second half of FY25 than in the first half due to higher content amortization and sales-and-marketing costs. The company also raised its full-year revenue forecast to $44.8-45.2 billion.

Growth Drivers

After Netflix hiked prices across the platform recently, there has been strong momentum in its top-line performance. The company has rolled out its ad suite in key markets and aims to double ad revenues this year. The bullish outlook reflects the growing viewership of popular shows like Squid Game, Ginny & Georgia, and Sirens. Although its forward guidance and growth strategy are impressive, the company must remain focused on addressing competitive pressures and improving operating margins.

From Netflix’s Q2 2025 Earnings Call:

“We want to be in business with the best creatives on the planet. Regardless of where they come from. Some of them are here in Hollywood. Others are Korea, and some are in India. And some are creators that distribute only on social media platforms, and most of them have not yet been discovered. So, for those creators doing great work, we have phenomenal distribution. Desirable monetization, brilliant discovery in our UI, and a hungry audience waiting to be entertained.”

Netflix’s stock was trading down 5% on Friday afternoon, after opening the session sharply lower. The last closing price is up 36% from the levels seen at the beginning of 2025.