There are any number of rumors that Jay Powell is being forced to resign. President Donald Trump, of course, is on his case daily for not dropping interest rates in line with low inflation.

Just a few moments ago, William Pulte, head of the Federal Housing Finance Agency that regulates Fannie Mae and Freddie Mac and oversees the eleven federal home loan banks, issued a statement, saying: “I’m encouraged by reports that Jerome Powell is considering resigning. I think this will be the right decision for America, and the economy will boom.”

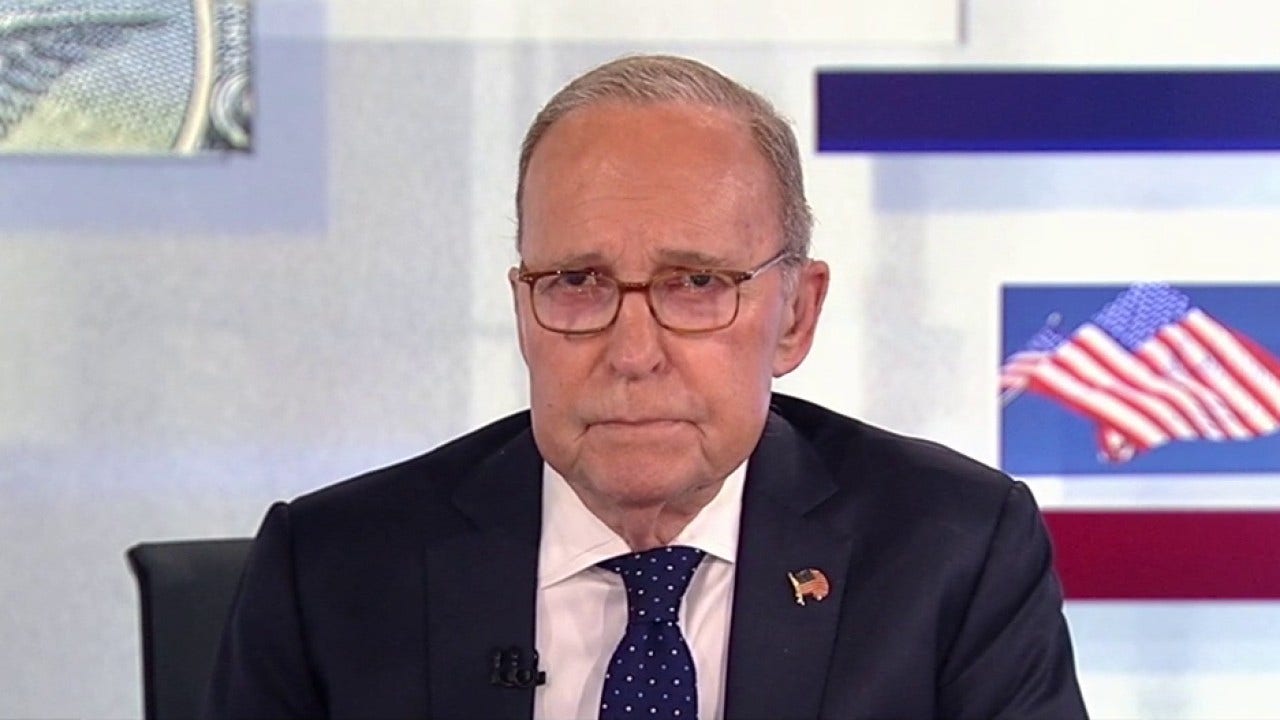

National Economic Council Director Kevin Hassett discusses President Donald Trump’s Federal Reserve reform plans on ‘Kudlow.’

Yesterday, Office of Management and Budget Director Russ Vought blasted Powell for his gross mismanagement of what Vought calls the Palace of Versailles saying “We saw Chairman Powell. He was too late to recognize inflation, and now he’s too late to lower rates. And the Fed has just mismanaged the institution. And we see that the extent to which they’ve been operating at losses for a number of years now is for the first time in their history. And then you just see a very practical example when you go to the nation’s mall. You see the construction of this palace, in the words of one former official, upwards of $2.5 billion, massive cost overrun.”

And this $2.5 billion monstrosity of Powell’s is already overbudget by $700 million.

OMB Director Russ Vought second guessed Powell’s Senate testimony under oath that there’s no VIP dining room, no new marble, no special elevators, no new water features, no bee hives, and no roof terrace garden. Vought noted that the Fed’s Taj Mahal is way out of compliance with the National Capital Planning Act.

Powell has long argued that he can’t be replaced except “for cause.” But this kind of blatant financial mismanagement over the Fed’s new building and the renovations of the old building could well represent sufficient “cause” to force his resignation, or even be fired by President Trump.

Meanwhile, economists are pointing out that the Fed is hemorrhaging cash as their interest expenses exceed interest taken in. And their $6 trillion-plus bond portfolio is underwater by $1.1 trillion.

This has all the earmarks of the bankruptcy of the Silicon Valley Bank, that went under in March of 2023 — and almost pulled the financial system down with it.

So, now the question is: can Jay Powell even make it through the weekend? We will see.