Lemonade (LMND) is within the information after asserting the event of a brand new insurance coverage coverage for self-driving vehicles, starting with the Full Self-Driving (FSD) system provided in Tesla (TSLA) automobiles. The information was met with an instantaneous response within the inventory market. LMND inventory noticed an uptick in shares — up 9% on Jan. 21 and 13% on Jan. 22 — as did Tesla inventory.

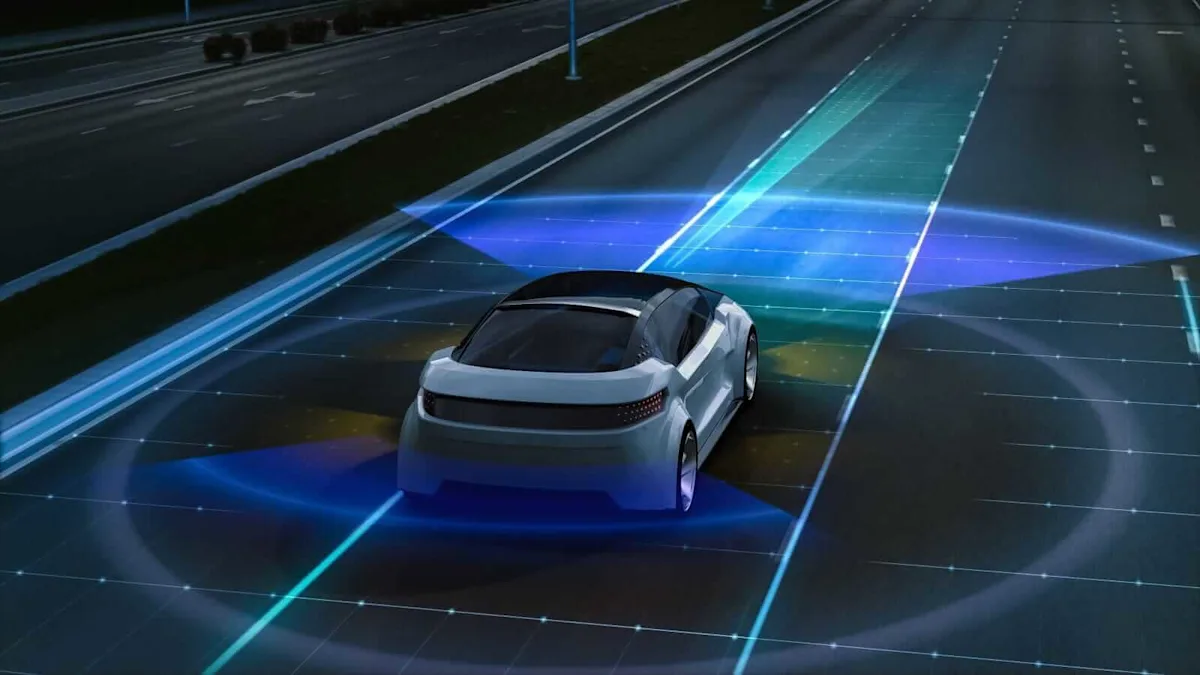

Probably the most outstanding a part of the announcement was unattainable to miss: Lemonade is promising to lower its per-mile charges by about 50% with FSD enabled, primarily based on knowledge that demonstrates accident charges lower considerably with FSD mode engaged. Moreover, Lemonade anticipates that its insurance coverage premiums will proceed to lower as Tesla improves its FSD software program packages in future releases. Merely acknowledged, Lemonade is betting that improved autonomy interprets into decreased danger that will probably be capable of precisely assess for his or her policyholders.

This additionally comes at an essential time as traders reassess the insurance coverage, knowledge, and AI nexus. Utilization-based pricing fashions have at all times been a sought-after objective within the automotive insurance coverage house, though entry to Tesla automotive knowledge might probably symbolize a paradigm shift.

Lemonade, a tech-enabled insurance coverage firm serving renters, householders, pets, life, and most not too long ago auto insurance coverage insurance policies, has established itself as a tech-driven various to conventional insurers utilizing AI, automation, and behavioral economics. Lemonade has a complete valuation of round $7. billion by way of market capitalization and relies in New York.

LMND inventory has skilled a formidable run. In truth, the inventory has risen by 181% within the final 12 months alone, buying and selling for round $93 per share, simply in need of its $99.90 excessive. Within the final 12 months, the S&P 500 Index ($SPX) has risen by solely a fraction of the beneficial properties skilled by LMND. Therefore, speculative future beneficial properties could be gauged from the efficiency of the inventory.

LMND inventory remains to be extremely valued. Lemonade will not be but worthwhile and at present trades at 10.35 occasions gross sales and greater than 13 occasions guide worth. These valuations far exceed these of conventional insurance coverage corporations. Nonetheless, the case for Lemonade is a unique enterprise mannequin — one powered by AI underwriting and a rising loss ratio.

Story Continues