77

Normal Financial institution Company and Funding Banking, will host the second version of its seminal African Markets Convention (AMC 2026).

The flagship occasion will happen on 22-24 February 2026 in Cape City, South Africa, bringing collectively international institutional buyers, sovereign wealth funds, and African policymakers to catalyse the circulation of capital into the continent’s most important sectors.

Luvuyo Masinda, Chief Government of Company and Funding Banking at Normal Financial institution Group says AMC 2026 builds on the success of the inaugural 2025 convention, which reframed Africa’s narrative from danger to resilience.

“This yr’s engagement bridges the hole between coverage ambitions and market realities. Africa urgently wants sensible measures to deepen capital swimming pools, enhance market liquidity, and strengthen regulatory frameworks that give buyers confidence to deploy capital at scale. Mobilising capital isn’t just about funding tasks; it’s about constructing the muse of a extra balanced and inclusive international financial system,” says Masinda.

It’s estimated that by 2050, Africa will add one billion folks, greater than half in cities, but it invests solely $75 billion of the $150 billion it wants yearly for infrastructure. Normal Financial institution goals to make use of AMC 2026 to make sure that African priorities stay on the centre of the worldwide monetary discourse.

The convention will probably be structured round 5 high-impact pillars designed to maneuver the needle on funding:

Prioritising infrastructure as an Asset Class: Shifting past assist towards public-private partnerships (PPPs) that flip important tasks into investable property for the personal sector.

Accelerating the Power Transition: Positioning Africa as a cornerstone of worldwide power safety by unlocking its renewable potential by means of progressive options.

Deepening African Capital Markets and mobilising personal capital: Enhancing home liquidity, bettering regulatory transparency, and increasing entry for institutional buyers.

Enabling intra-African commerce and flows of capital: Highlighting the significance of deeper regional integration for Africa to draw Overseas Direct Funding (FDI) within the present unsure international funding local weather. Leveraging the African Continental Free Commerce Space (AfCFTA) for a bigger, extra predictable market that encourages intra-African funding.

Africa’s Sovereign Debt and Value Sustainability: Addressing the debt requirement in closing Africa’s developmental wants. The dialogue is reframed from entry to affordability, credibility and construction, with associated perceived danger premium and the event of capital markets.

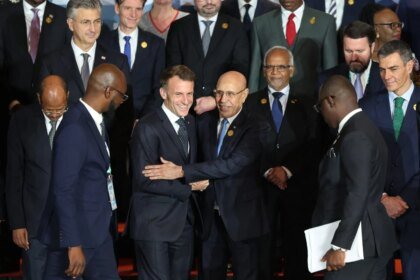

AMC 2026 will host a high-level delegation of decision-makers, guaranteeing that the dialogue results in tangible commitments. Confirmed contributors embrace:

Finance Ministers, Ministers in Infrastructure growth and Central Financial institution Governors from key African progress hubs.

International Asset Managers and Institutional Traders looking for yield and sustainable influence.

Improvement Finance Establishments (DFIs) and multilateral businesses targeted on de-risking frameworks.

Normal Financial institution executives, together with Sim Tshabalala CEO of Normal Financial institution Group, Luvuyo Masinda (CEO, CIB), Sola Adegbesan (Head of International Markets Africa Areas) and Alex Davidson (Head of International Markets SA), will lead technical periods on market liquidity.

The 2026 African Markets Convention represents a collective name to motion for the private and non-private sectors. It’s a platform the place the roadmap for Africa’s progress will probably be charted, debated, and in the end, accelerated.