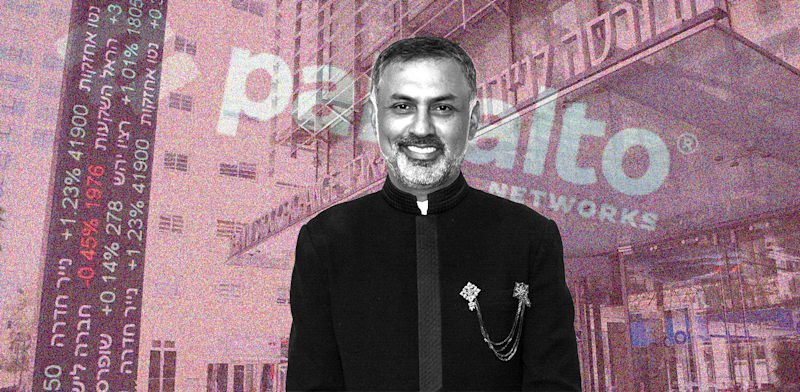

The Tel Aviv Inventory Alternate (TASE) stories that US cybersecurity large Palo Alto Networks (Nasdaq: PANW) will start buying and selling on the TASE subsequent Monday, February 23. This follows the completion of the acquisition of Israeli cybersecurity firm CyberArk (Nasdaq: CYBR) and Palo Alto’s choice to dual-list on the TASE. The belief in the marketplace was that the method of itemizing on the TASE would take a number of months however in follow it’s taking place a lot quicker.

Palo Alto Networks is at present traded on Wall Avenue at $152.35 per share, giving a market cap of $123 billion. The greenback has strengthened immediately in opposition to the shekel to NIS 3.14/$, which implies that if Palo Alto Networks started buying and selling immediately it might have a market cap of NIS 387 billion.

That is triple the market cap of Teva Pharmaceutical Industries Ltd. (NYSE: TEVA; TASE: TEVA), which is at present essentially the most precious firm traded on the TASE. Palo Alto’s market cap equals the mixed whole of the following 4 most useful corporations on the TASE – Financial institution Leumi (TASE: LUMI), Financial institution Hapoalim (TASE: POLI), Elbit Methods Ltd. (Nasdaq: ESLT; TASE:ESLT), and Mizrahi Tefahot Financial institution

If and when will Palo Alto enter the indices?

The large query now’s if and when Palo Alto will be part of the most important TASE indices – the Tel Aviv 35 and Tel Aviv 125. The market assumption is that the corporate shall be quick tracked onto these indices. Within the meantime, the TASE itself doesn’t but know the reply to this query.

Formally, Palo Alto missed the deadline for the definitive registration to enter the indices, which was February 14, however it’s definitely doable that the TASE shall be versatile and permit the cybersecurity firm to enter the indices as early because the semi-annual replace in Could. The TASE may even must determine whether or not Palo Alto is a “international firm” or one which has important exercise in Israel. Following the acquisition of CyberArk, this risk is definitely affordable.

One other risk is that Palo Alto will enter the indices on a quick monitor as a part of the replace of the parameters (weight) in August.

Who would be the corporations pushed out because of this?

RELATED ARTICLES

Palo Alto Networks to listing on TASE

Palo Alto Networks to purchase Israeli co Koi Safety for $400m

700 CyberArk staff to lose jobs after $25b exit

An organization that’s already within the Tel Aviv 35 Index should be one of many 39 largest on the TASE within the “ten decisive days” (a couple of month earlier than the replace itself) so as to not be excluded from it. Alternatively, an organization that desires to enter should be in at the least thirtieth place (or have the very best market cap amongst these outdoors, assuming one leaves). Since Palo Alto will after all be within the high 30, if it joins the indices already within the Could replace, the end result shall be that the corporate with the smallest market cap within the Tel Aviv 35 index shall be relegated.

As of immediately this may be YH Dimri Development and Growth (TASE: DIMRI), which is the forty fifth largest firm on the TASE. However Mivne Actual Property (TASE: MVNE) and Fattal Holdings (1998) (TASE: FTAL), ranked 42 and 43, are additionally candidates to drop out of the Tel Aviv 35 Index. A number of corporations may very well be relegated as Mega Or (TASE: MGOR), ranked 28, can be a candidate for promotion. The inventory of the Tel Aviv Inventory Alternate (TASE: TASE) itself, ranked 31, can be a candidate for promotion to the Tel Aviv 35 Index. However a lot can change within the weeks till the composition of the indices is determined.

Revealed by Globes, Israel enterprise information – en.globes.co.il – on February 19, 2026.

© Copyright of Globes Writer Itonut (1983) Ltd., 2026.