Insights At a Glance:

- Samsung leads the pack, rising from 24.32% to 30.32% and extending its dominance in Kenya.

- Transsion brands (TECNO, Infinix, Itel) are seeing steady declines despite new launches.

- Xiaomi is the sleeper hit, growing from 5.38% to 7.46% with a strong upward trend since December 2024.

The smartphone market share in Kenya has undergone some pretty dramatic shifts over the past year, and if there was ever a time to say the mobile space is heating up, it’s now. From Samsung’s impressive rise to Xiaomi’s steady comeback and the surprising dip in Transsion’s dominance, Kenya’s smartphone landscape is changing fast. We’ve been glued to the numbers, watching the constant shifts in consumer preference that define who gets the biggest piece of the pie.

So, let’s unpack the latest stats from Statcounter and see how the battle for the smartphone market share in Kenya has unfolded.

Where the Brands Stand

| Brand | June 2024 | June 2025 | Trend |

|---|---|---|---|

| Samsung | 24.32% | 30.32% | 🔼 Rising sharply |

| TECNO | 16.98% | 13.43% | 🔽 Steady decline |

| Infinix | 8.46% | 7.6% | 🔽 Fading |

| Xiaomi | 5.38% | 7.46% | 🔼 Rising |

| Nokia | 8.93% | 5.34% | 🔽 Declining |

| Apple | 4.0% | 4.97% | 🔼 Growing |

| Oppo | 7.68% | 7.43% | ⏸ Stable |

| Huawei | 2.77% | 2.43% | 🔽 Declining |

| Itel | 4.26% | 3.0% | 🔽 Dropping |

| Unknown | 10.99% | 11.34% | 🔼 Slight gain |

Samsung Surges Past 30% in Smartphone Market Share in Kenya

Samsung is not just winning. It’s on fire. The brand has jumped from 24.32% in June 2024 to a commanding 30.32% in June 2025, extending its lead in the smartphone market share in Kenya to unprecedented heights. The growth wasn’t just luck. April 2025 (27.57%, up from 27.15% in March) kicked off a solid growth streak, followed by May (29.24%) and the latest June (30.32%), marking Samsung’s most dominant run in over a year.

With its popular Galaxy A-series hitting the sweet spot for value, and consistent software updates building trust, Samsung is pulling away from the pack. This local dominance also mirrors its global performance, where it remains the top global smartphone vendor as per the latest Q2 2025 report. However, with Samsung Kenya sitting out the official launch of the Galaxy Fold 7 and Flip 7, it will be interesting to see if this affects its dominant smartphone market share in Kenya in the second half of the year. (Spoiler alert: It won’t!).

Tecno Loses Its Footing Amidst Rising Rivals

A year ago, Tecno was Samsung’s fiercest competitor in the smartphone market share in Kenya, but the tides are shifting. The brand’s market share in Kenya dropped from 16.98% in June 2024 to 13.43% in June 2025, a noticeable decline that gained speed from April 2025 onward. What’s even more surprising is that this dip comes despite new smartphone launches in 2025. But the numbers say it all: the market simply isn’t biting the way it used to.

Is Kenya cooling off on TECNO? Or is it simply being outgunned by rivals like Samsung and Xiaomi?

Interestingly, this dip comes even as Transsion Holdings, the parent company of Tecno, Infinix, and Itel, continues to shine in Africa. According to Canalys Q1 2025 insights, Transsion brands led regional growth. Still, it appears Tecno’s smartphone market share in Kenya is being quietly chipped away, and it’s the same story for its own siblings, Infinix and Itel.

Infinix Follows the Same Declining Path

Much like its Transsion sibling, Infinix is also sliding. From 8.46% in June 2024 to 7.6% in June 2025, the drop may not be dramatic, but it’s steady and telling. Despite multiple phone launches in 2025, Infinix hasn’t managed to reverse the trend, and that puts its once-growing dominance at risk.

This twin decline in smartphone market share in Kenya by both TECNO and Infinix begs the question: Are Transsion brands finally fading away in Kenya? Once hailed for unbeatable value, it appears consumers are now looking elsewhere for innovation and reliability.

Back in September 2024, Infinix saw 18.8% YoY growth, a milestone that’s not reflected in its declining smartphone market share in Kenya. With solid specs, fresh designs, and a youth-focused marketing push, Infinix could perhaps get back to its glory days.

Xiaomi Is the Comeback Story of the Year

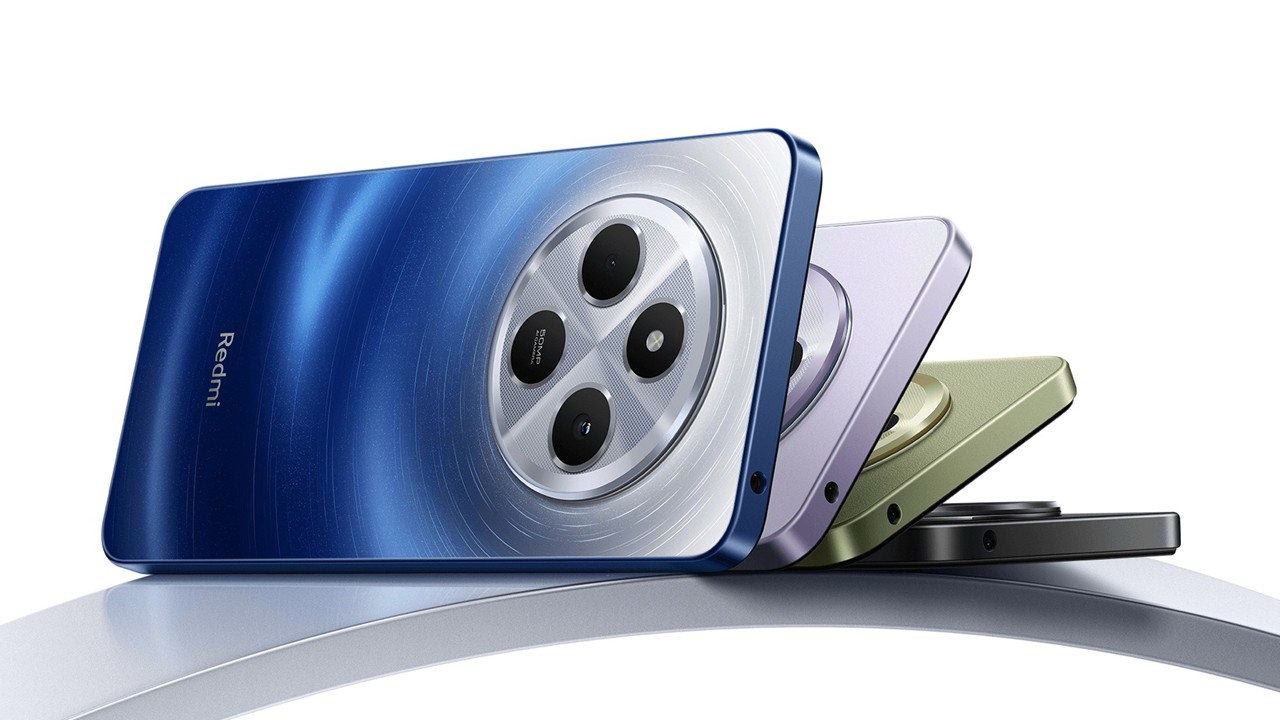

Amid all this reshuffling, Xiaomi is steadily climbing the ranks. From 5.38% in June 2024 to 7.46% in June 2025, the brand has enjoyed consistent month-on-month growth since December 2024, a trend that shows no signs of stopping.

With its smart balance of affordability and performance, especially with devices like the Redmi Note 14 series and Redmi 14C, Xiaomi is gaining real traction. If the current trend holds, it might soon overtake Infinix to become Kenya’s third-largest Android player by market share.

Other Brands: Mixed Fortunes in a Crowded Market

The rest of the players in the smartphone market share in Kenya have seen a mix of ups and downs:

- Itel, Transsion’s most budget-friendly brand, also declined from 4.26% to 3.0% over the year.

- Unknown brands (likely grey-market imports and niche OEMs) have ticked upward slightly from 10.99% to 11.34%, proving there’s still a place for budget, off-the-radar options.

- OPPO saw a minor slip from 7.68% to 7.43%, staying relatively stable but not making any big moves.

- Nokia, on the other hand, took a hit — down from 8.93% to 5.34%, marking one of the sharpest declines in the market. The brand’s failure to keep up with specs, design trends, and marketing may finally be catching up.

- Apple showed unexpected growth, rising from 4.0% to 4.97% to record a strong performance in a price-sensitive market. The iPhone SE series and second-hand iPhones likely contributed to the climb.

- Huawei, still reeling from its Google ban, slid further from 2.77% to 2.43%.

Transsion’s Woes: A Shift in the Power Balance?

The combined decline of TECNO, Infinix, and Itel paints a concerning picture for Transsion in the smartphone market share in Kenya. Once dominant across all tiers, budget to mid-range, the group is now under serious threat from a rising Samsung and a rebounding Xiaomi.

This contrasts sharply with regional trends, where Transsion still led in Canalys’ Q1 2025 Africa smartphone growth report. Clearly, Kenya is breaking away from the broader continental pattern, a sign that the market is maturing faster than many expected. If the current trajectories continue, we could see Xiaomi move up another spot and TECNO drop even further. Samsung’s position looks unshakable for now, and Apple’s slow but steady rise signals growing interest in premium experiences even in an economy under pressure.

As AI features, camera performance, and long-term software support become more important to buyers, the brands that adapt quickly will capture the future smartphone market share in Kenya.