Fanatics Betting & Gaming CEO Matt King discusses Superbowl bets, a industrial collaboration with Kendall Jenner and extra on ‘The Claman Countdown.’

Gamers who will take the sector for Tremendous Bowl LX on Sunday will face a major tax invoice as a result of recreation’s location triggering what’s referred to as a “jock tax.”

Tremendous Bowl LX might be performed in Santa Clara, California, and the Golden State is one among a lot of states that has applied a so-called jock tax on skilled athletes, which assesses taxes on gamers primarily based on the variety of days they spend enjoying or practising in a given jurisdiction – together with these away from their dwelling state.

The NFL’s collective bargaining settlement units the bonuses paid to gamers on each the profitable and dropping sides of the Tremendous Bowl – gamers on the profitable crew every obtain a $178,000 pay day whereas gamers on the dropping crew will get $103,000.

Jeffrey Degner, a analysis fellow in economics on the American Institute for Financial Analysis, informed FOX Enterprise that whereas these bonuses are “nothing to sneeze at,” the quantity that gamers will really take dwelling after taxes just like the jock tax and different state and federal liabilities is significantly smaller.

FANATICS SPORTSBOOK SEES MAJOR SPIKE IN DOWNLOADS FROM KENDALL JENNER’S VIRAL SUPER BOWL AD CAMPAIGN

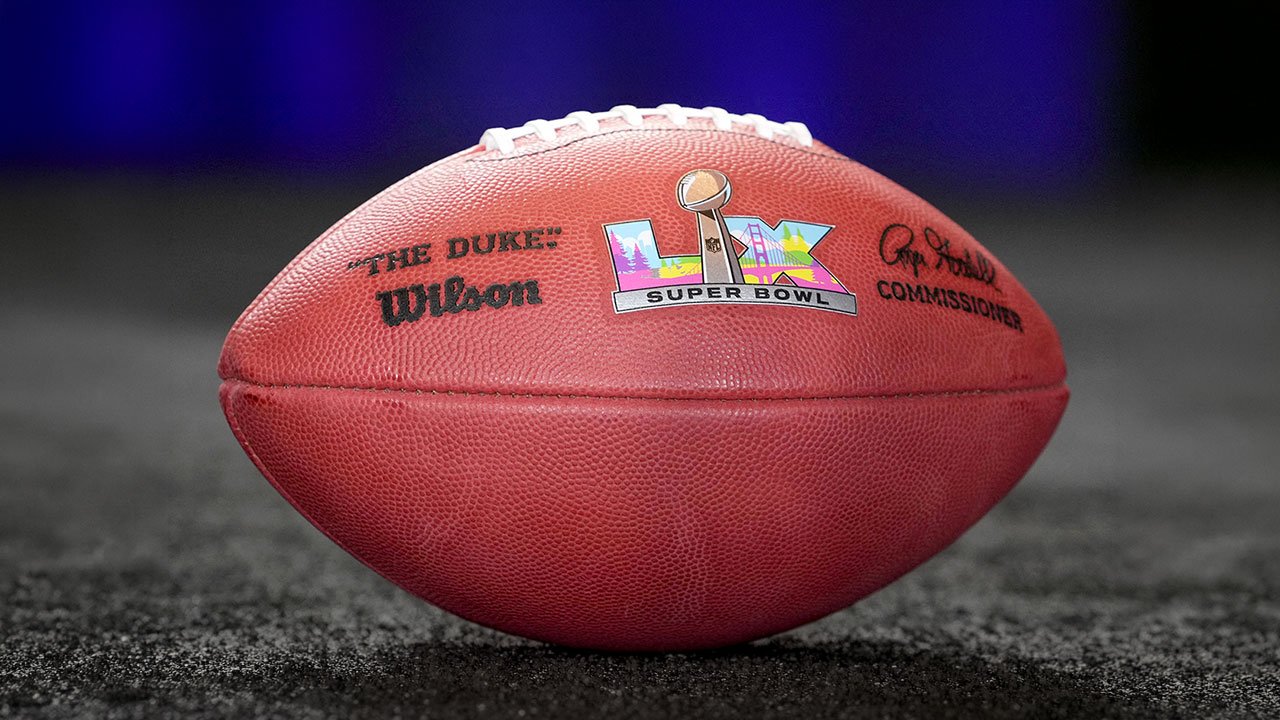

Tremendous Bowl LX will air on Feb. 8 at Levi’s Stadium in California. (Kirby Lee-Imagn Pictures through Reuters)

“What which means right here is that the profitable crew, their take-home pay might be roughly $86,000. In case you’re on the dropping facet, the take-home could be about $49,800,” Degner stated.

Jock taxes apply to NFL gamers all through the season in jurisdictions after they’re in impact, so any time they play or observe in an space the place a jock tax has been applied, they will be topic to the tax on revenue earned that day.

‘SUPER BOWL BREAKFAST’ RETURNS WITH FOCUS ON LEADERSHIP AND LEGACY AHEAD OF NFL SHOWCASE

Tremendous Bowl LX might be held at Levi’s Stadium in Santa Clara, California, triggering the state’s jock tax. (Ishika Samant/Getty Pictures)

Each states and cities can implement jock taxes, including layers of complexity to the participant’s tax burden, although they continue to be extra well-liked on the state stage than in municipalities.

Most jock taxes are applied utilizing a “responsibility day” normal, as different frameworks have confronted challenges in courtroom in addition to feasibility points.

SOUTHWEST TO DEBUT NEW SUPER BOWL AD, SHOWCASING ITS ‘SELF-AWARE’ HUMOR

Tremendous Bowl winners take dwelling bigger bonuses than gamers on the dropping crew, who nonetheless obtain a major verify. (Timothy A. Clary/AFP through Getty Pictures)

The responsibility day format makes use of the variety of days an athlete spends “on responsibility” enjoying in a recreation, practising, taking part in crew conferences, journey days and – within the case of the Tremendous Bowl – fulfilling team-related media obligations.

The whole earnings are multiplied by a ratio of responsibility days spent in a given jurisdiction out of the athlete’s complete responsibility days to find out the jock tax legal responsibility.

“The times on responsibility embrace days whenever you’re practising or, within the case of the Tremendous Bowl, even the media day counts as a day on responsibility and if that exercise is going on in California, you are topic to these tax guidelines,” Degner stated.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“The gamers have a extremely advanced tax scenario the place they’ll have 10 or extra completely different states that they are having to file taxes for,” he stated. “That is why a whole lot of these younger gamers, it is actually necessary for groups to settle them in with sharp monetary advisors and tax advisors in order that they do not lose their shirts, so to talk.”