- Driving climate action means improving the quality of climate investments, as well as increasing their volume.

- High-quality climate finance goes beyond one-off project-level interventions to deliver sustained transformational change—at the market- and system-levels.

- This blog presents a quick-read overview of CPI’s framework for understanding climate finance quality, a first step toward establishing a common language for collective action, across multiple public climate finance providers.

From fragmentation to shared understanding

Public climate finance providers have long acknowledged the importance of climate finance quality—parallel to the emphasis on quantity. However, to date, a common understanding of what high-quality climate finance looks like, in practice, has not yet emerged across multiple public actors.1

For some, climate finance quality refers to its level of concessionality or ease of access (UNFCCC, 2024). For others—notably climate finance providers—quality can be synonymous with the amount of additional (private) finance an intervention mobilizes (OECD, 2023). From another angle, quality relates to delivering on core climate results: The extent to which emissions are mitigated and beneficiaries’ lives improved by increasing “adaptive capacity”.

Shared language and definitions surrounding climate finance quality can break assessments out of institution- (or coalition-) specific siloes. Creating such a common understanding can provide opportunities to aggregate assessments from multiple public actors to build a picture of the quality of global public climate finance as a whole, producing insights for strategic and optimal deployment moving forward.

Three levels of quality

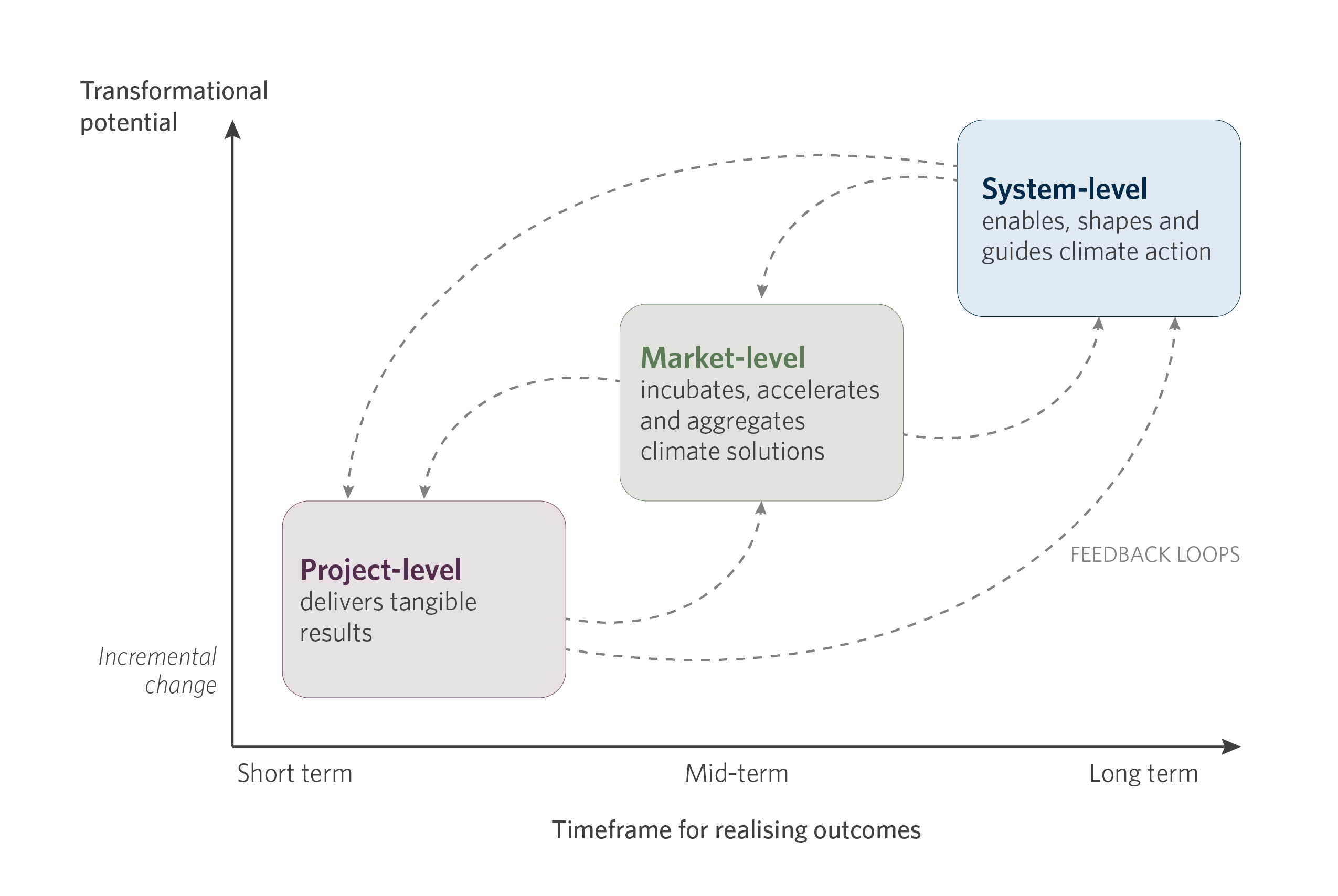

CPI’s recent study—Understanding the Quality of Climate Finance—takes a first step toward this end. It proposes a three-level framework that broadens the perspective beyond one-off project-level interventions to consider how climate finance quality can be understood as the degree to which climate finance is expected to deliver sustained transformational change—at the market and system levels—toward low-emission, climate-resilient, and equitable economies.

Figure 1: Three analytical levels for assessing climate finance quality

Level 1: The project

The project level is the smallest, and most common, unit of intervention at which public climate finance providers deliver results. Here, inputs (mitigation finance; adaptation finance; or technical assistance) yield so-called “outputs” and “outcomes,” where the end goal—or “impact”—is to keep the global temperature rise to well below 2°C and/or to avoid the (economic or non-economic) loss and damage associated with climate shocks or stresses.

Results chain terminology:

| TERM | MITIGATION EXAMPLE | ADAPTATION EXAMPLE |

|---|---|---|

| Inputs | Concessional debt (and in-kind technical assistance) | Grants (and in-kind technical assistance) |

| Outputs | Construction and operation of a solar power plant | Socializing and increasing the uptake of climate-smart agricultural practices in a water-stressed context, including the provision of drought-resistant seeds |

| Outcomes | Emission reductions over business-as-usual (measured in tonnes of CO₂e) | Increased agricultural yield during droughts (measured in tonnes/hectares per year) |

| Impact | Global temperature rise is kept well below 2°C | Avoided (economic and non-economic) loss and damage during droughts |

While project-level evaluations can be resource-intensive and technically demanding, many public climate finance providers have established robust monitoring and evaluation systems to track, report on, and learn from their project-level interventions. Aggregating these project-level results—or key performance indicators—across whole portfolios allows finance providers to demonstrate the scale of their results for a given time period. However, there is also a risk of converging on the lowest common denominator—applicable to a wide range of interventions, which may, nonetheless, reveal little about the degree of success in practice. That is: what worked (or didn’t); for whom did it work; and what may be scaled or replicated moving forward? In short, the project level offers a means of delivering tangible, direct, local, and time-bound results.

Level 2: The market

The market level assesses whether, or to what extent, climate finance induces market change by stimulating demand and supply for climate solutions. The key objective here is to create, develop, or stabilize markets for climate solutions, thereby developing whole market ecosystems ahead of scaling. On the demand side, this may involve influencing the willingness and ability of end-users, consumers, investors, or businesses to adopt or invest in a climate solution. On the supply side, the emphasis is on production, provision, and scaling of a particular climate solution, such as reducing the costs of innovative technologies, incubating frontier green industries, or providing a demonstration effect for other market participants. Additionally, on the enabling side, efforts may be concentrated on establishing specific policies, strategies, and technical capacities for deployment and uptake of a nascent climate solution.

Measuring the market-level changes facilitated, or directly engineered, by a public climate provider and their specific project-level intervention(s) can be complex. Market-level effects tend to be indirect, altering core market dynamics that, in turn, activate additional resources and lead to the emergence of a market ecosystem over the medium to long term. Nonetheless, certain public climate finance providers and/or coalition groups are exploring, or already utilize, approaches for assessing their contribution to market outcomes: for example, the IFC’s Anticipated Impact Measurement and Monitoring (AIMM) framework assesses the extent to which their interventions establish competitive, resilient, and sustainable markets (IFC, 2025).

Level 3: The system

The third and final level—that of the system within which project- and market-level change takes place—is more abstract and aggregate. The system-level enables, shapes, guides—or possibly results from – action at the project- and market-level. Systems include, for example, power, transport, industry, cities, finance, food and agriculture, among others (Jaeger et al., 2022). Here, CPI distils four key dimensions or entry points for catalyzing system change: guiding paradigms and values; behaviors and attitudes; policies and regulations; and institutional arrangements. The system-level is distinct from market-level interventions given that the scope and ambition is to shape and shift whole economies and sectors therein, rather than focusing on specific parts of a system (e.g., building the EV market in the transport sector). Tracking system-level change—and attributing it to individual actors or interventions—is even more complex than at the other levels, given that system-level outcomes are only realized over a longer time horizon and culminate from the amalgamation of various actions by various actors, at different scales.

Dimensions for catalyzing system-level change

| DIMENSION | DEFINITION |

|---|---|

| Guiding paradigms and values | The guiding concepts, principles or thought models within which, and toward which, the system—people, policies, institutions, and economies—works. |

| Behaviours and attitudes | Changing behavior or shifting social norms such that they are conducive to sustainable, low-emission, climate-resilient, and equitable economies. |

| Policies and regulations | Creating or facilitating long-term and holistic policies, strategies, legal frameworks, governance structures, and the capacity needed to raise ambition on—and ultimately implement—climate action at a national or subnational level for an entire system. |

| Institutional arrangements | Creating or facilitating the (inter- or intra-) institutional arrangements and organizational structures that may enable systematic coordination and cooperation within the global climate finance landscape. |

Defining Quality

CPI adopts a broad approach to exploring and defining the quality of climate finance, considering the degree to which it delivers sustained transformational change at the market and system levels, ultimately leading to low-emission, climate-resilient, and equitable economies. That is, action at each level is important—including more traditional project-based approaches—but there is a need to broaden the focus to the market- and system-levels in order to truly move the needle towards transformational outcomes. Transformational climate finance—a term commonly cited in discussions—is, then, finance that works to deliver positive and sustained change at the market and system levels within which action is implemented.

Transformational climate finance, by definition, is high-quality climate finance.

Figure 2: Visualizing transformational climate finance

In addition, CPI identifies ten key dimensions for assessing the transformational potential of public climate finance, based on extensive literature review and institutional knowledge (gathered from multiple engagements in high-level climate finance discussions and assignments (G20 IHLEG, 2024)). The ten dimensions are:

CPI’s Understanding the Quality of Climate Finance scoping study is a first step toward establishing a common framework for collective action. A shared understanding of climate finance quality—shared by multiple public climate finance providers—can help lay the groundwork for tracking and aggregating data points to offer insight into what is working, for whom, and what may be scaled or replicated moving forward.

CPI’s Climate Finance Tracking program—compiling and analysing climate finance data across a range of actors in the Landscape; and promoting convergence and coordination, where possible and relevant—is well-placed to move this conversation forward, with scope to share learnings from the data and evidence, so as to inform future strategies for the optimal use of public climate finance.

CPI’s next steps will be to apply the three-level conceptual framework using real-world data in sectoral or thematic contexts (e.g., adaptation, or for a specific sector in a particular country). This is an iterative process: applying the framework in practice will help refine it. Importantly, the next phase will focus on informing efforts to standardize climate finance quality indicators across multiple public climate finance providers.

Ultimately, the goal is to be able to analyze both the quantity (current flows and estimated needs) and quality (transformational potential) of climate finance (see Figure 3). As actors begin building out the Baku-to-Belém Roadmap for scaling international climate finance for emerging markets and developing economies to USD 1.3 trillion, annually by 2035, emphasizing the quality of that finance will be equally important to deliver on global climate and broader sustainable development goals at the pace needed in the coming decade and beyond.

Figure 3: CPI’s Climate Finance Tracking program vision

References

UNFCCC. 2024. CMA Sixth session. Available at: https://unfccc.int/sites/default/files/resource/cma2024_09.pdf

OECD. 2023. Glossary of Key Terms in Evaluation and Results-Based Management for Sustainable Development (Second Edition). Available at: https://www.oecd.org/en/publications/glossary-of-key-terms-in-evaluation-and-results-based-management-for-sustainable-development-second-edition_632da462-en-fr-es.html

IFC. 2025. AIMM Dimensions. Available at: https://www.ifc.org/en/our-impact/measuring-and-monitoring/aimm-dimensions

Jaeger et al., 2022. Methodology Underpinning the Systems Change Lab Platform. Available at: https://systemschangelab.org/sites/default/files/2022-11/Systems%20Change%20Lab%20Technical%20Note%20November%202022.pdf

G20 IHLEG. 2024. Accelerating Sustainable Finance for Emerging Markets and Developing Economies. Independent High-Level Expert Group Review of the Vertical and Environmental Funds. Available at: https://www.climatepolicyinitiative.org/wp-content/uploads/2000/10/G20-IHLEG-VCEF-Review.pdf