Verto, a leading B2B global payments platform, has launched The Atlas Suite, a next-generation set of API-first embedded finance solutions designed to simplify cross-border payments. With a single multi-currency payment API, financial institutions, online marketplaces, e-commerce platforms, and white label brokers can access FX liquidity solutions, virtual accounts for businesses, and fully compliant international payments. This launch addresses the operational, regulatory, and cost challenges of Africa cross-border payment challenges and global money transfers.

For decades, Africa has struggled with fragmented financial systems, limited access to banking, volatile currencies, and high transaction costs. Atlas removes these barriers by offering instant access to virtual bank accounts for international trade, deep FX liquidity, and compliant infrastructure across 49 currencies. Companies can now expand into and out of Africa, process international transactions, and unlock new opportunities in global trade finance and fintech expansion into Africa.

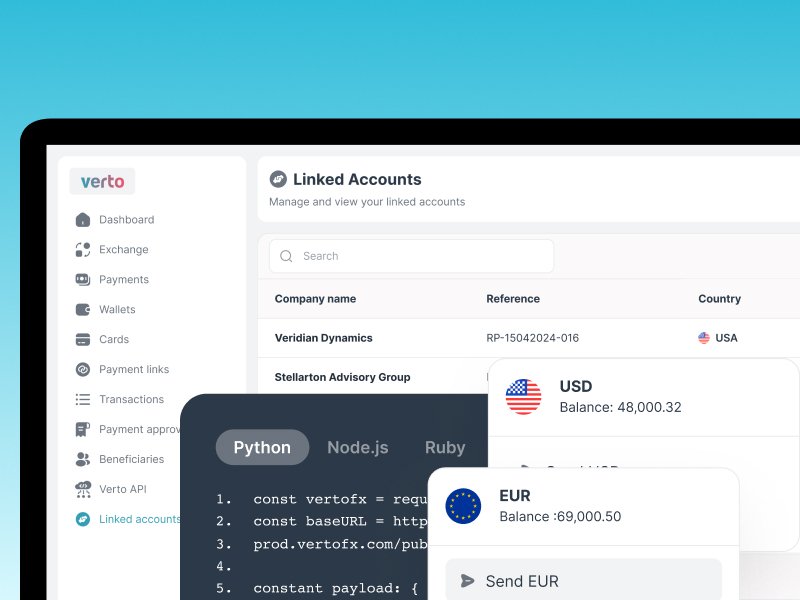

Atlas for Fintechs gives banks, fintechs, and other financial institutions the ability to integrate Verto’s banking, FX, and payments infrastructure directly into their platforms. Instead of building costly internal solutions or obtaining multiple licenses, businesses can, with one integration, provide local virtual accounts in 12+ markets, execute 24/7 foreign exchange across 49 currencies, and deliver international B2B payments Africa to over 100 countries—all in their own brand name.

Atlas for Platforms is designed for non-financial businesses, such as marketplaces and e-commerce providers. By embedding digital platforms with embedded payments, companies can offer customers seamless cross-border payments and banking services without needing in-house development or regulatory expertise.

White label brokers also benefit, as Atlas provides a fast, cost-effective way to deliver white label financial services providers under their own branding. They can add white label payment solutions, markup FX at preferred rates, and generate new revenue streams without taking on compliance or operational risks.

Ola Oyetayo, CEO of Verto, said: “We have seen firsthand how complex and costly it is for businesses to expand into new markets and move money, especially across Africa. Atlas is a game-changer, removing these barriers and giving our partners the freedom to grow.”

With advanced features, businesses using Atlas can open local collection accounts across Africa, manage multiple sub-accounts with FX and treasury management tools, and move seamlessly between currencies with integrated FX. The platform also supports mobile money payouts in Africa, enabling remittance providers and payroll companies to execute mass payments instantly via bank transfers or mobile money, fully compliant with local regulations.

Already, the solution is powering companies such as Triply, a Kenya-based travel-tech platform. Triply integrates Verto’s global payments platform to embed multi-currency payment solutions directly into its operating system for travel businesses. This allows customers to enjoy faster, more reliable, and compliant financial services across multiple currencies and markets.