FedEx Company’s (NYSE: FDX) second-quarter report underscored its resilience in a difficult market setting characterised by uneven demand, tariff tensions, and rising competitors. Administration issued cautious steering, citing progress in community optimization and value self-discipline, whilst freight market weak spot and operational headwinds weighed on sure segments. Though freight demand stays a priority, FedEx sees long-term positive factors from restructuring and digital investments.

Q2 Final result

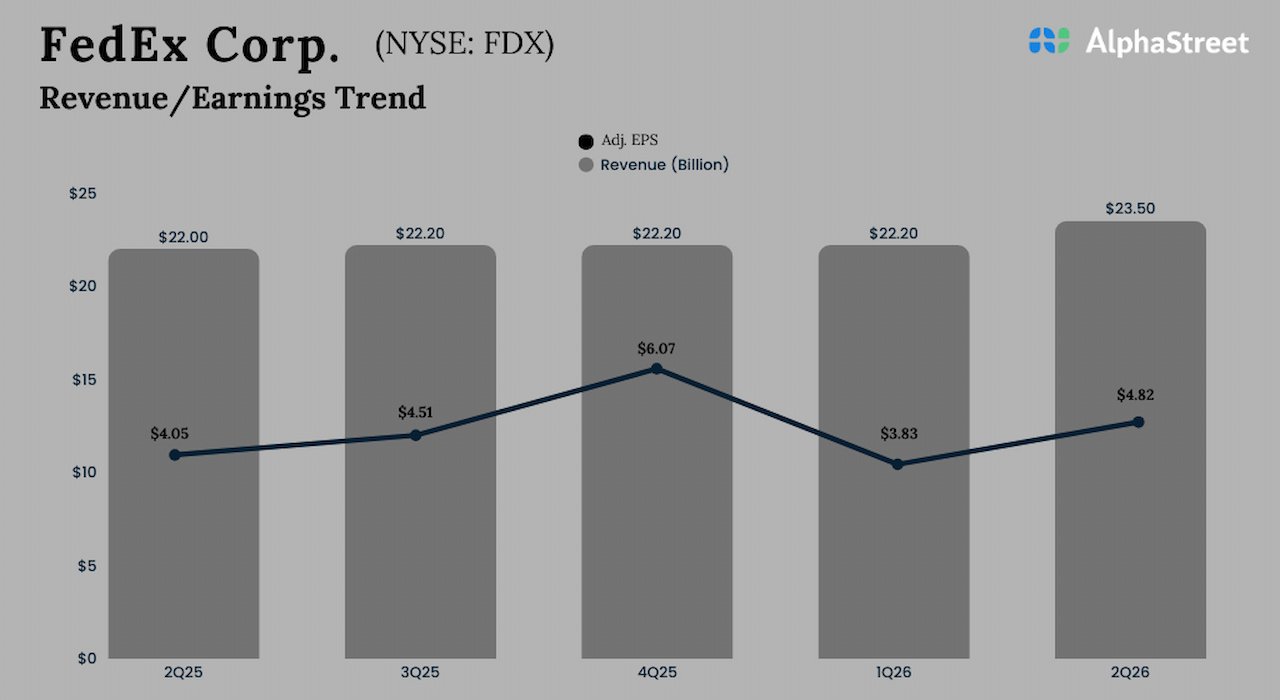

The cargo large’s second-quarter earnings, excluding particular gadgets, elevated to $4.82 per share from $4.05 per share within the year-ago quarter, exceeding Wall Avenue’s expectations. On a reported foundation, internet earnings was $956 million or $4.04 per share within the November quarter, in comparison with $741 million or $3.03 per share in Q2 2025. The underside-line development was pushed by a 7% development in revenues to $23.5 billion, which is above analysts’ forecasts.

The corporate’s inventory rallied on Thursday quickly after the announcement, however pulled again later, and the downturn prolonged into the pre-market on Friday. Investor sentiment was dampened by the administration’s cautious revenue forecast for the present quarter, citing incremental prices. After coming into 2025 on a low observe and dropping additional momentum within the early months, FDX bounced again and has been in restoration mode since then. It has gained about 28% prior to now six months.

Combined View

The FedEx administration stated it expects profitability to be impacted within the present quarter by extra prices associated to the surprising grounding of its MD-11 fleet on account of security issues. Regardless of headwinds like nationwide air visitors constraints, weak spot within the industrial economic system, and world commerce uncertainties, the corporate raised the midpoint of its FY26 forecasts. Fiscal-2026 income is predicted to develop 5-6% now. The steering for unadjusted earnings per share for 2026 is $14.80 to $16.00, and adjusted earnings are anticipated to be within the vary of $17.80 per share to $19.0 per share.

From FedEx’s Q2 2026 Earnings Name:

“Excessive single-digit income development, margin enlargement, and excessive teenagers adjusted EPS development. Fairly remarkably, we did this whereas navigating a number of exterior headwinds, together with the surprising grounding of our MD-11 fleet, nationwide air visitors constraints, weak spot within the industrial economic system, and naturally, the affect of worldwide commerce coverage modifications. We’re extraordinarily happy with our Q2 efficiency, particularly within the face of those challenges. It’s a direct impact of the rigor now we have embedded into our tradition over the previous a number of years and the ensuing transformation from Community 2.0, Tricolor, and structural price reductions, all enabled by information and know-how.

Spin Off

In the meantime, the FedEx Freight enterprise stays a drag on total efficiency amid continued stress on shipments. The administration is making ready to spin off this underperforming division as a individually listed public firm. In the latest quarter, FedEx Freight’s income dropped 2% on account of decrease common every day shipments.

The typical value of FedEx shares for the previous twelve months is $242.13. The inventory traded decrease on Friday afternoon, after opening the session decrease. It has gained 9% since final month.