Shutthiphong Chandaeng/iStock through Getty Photos

Expensive Fellow Investor,

That is the sixteenth annual letter to homeowners of the Fundsmith Fairness Fund (‘Fund’).

The desk under exhibits efficiency figures for the final calendar yr and the cumulative and annualised efficiency since inception on 1st November 2010 and varied comparators.

The Fund shouldn’t be managed on the subject of any benchmark, the above comparators are offered for info functions solely.

1 T Class Accumulation shares, internet of charges, priced at midday UK time, supply: Bloomberg.

2 MSCI World Index, £ internet, priced at US market shut, supply: Bloomberg.

3 Supply: Monetary Specific Analytics.

4 Bloomberg Collection-E UK Govt 5-10 yr Bond Index, supply: Bloomberg.

5 £ Curiosity Charge, supply: Bloomberg.

6 Sortino Ratio is since inception to 31.12.25, 3.5% threat free fee, supply: Monetary Specific Analytics.

The desk exhibits the efficiency of the T Class Accumulation shares, probably the most generally held share class and one by which I’m invested, which rose by 0.8% in 2025.

This compares with an increase of 12.8% for the MSCI World Index (‘Index’) in sterling with dividends reinvested. The Fund due to this fact underperformed this comparator in 2025. An extended-term perspective could also be helpful and is actually extra according to our funding goals and technique. Since inception, the Fund has returned 1.7% p.a. greater than the Index and has performed so with considerably much less draw back worth volatility as proven by the Sortino Ratio of 0.75 versus 0.48 for the Index. This merely signifies that the Fund has returned about 56% greater than the Index for every unit of worth volatility, of which extra later.

Our Fund is the third finest performer within the Funding Affiliation World sector of 155 funds since its inception in November 2010, with a return 322 proportion factors above the sector common.

Outperforming the market and even making a optimistic return shouldn’t be one thing you must count on from our Fund in yearly or reporting interval, and outperforming the market was difficult as soon as once more in 2025.

Earlier than I flip to the explanations for the efficiency I ought to clarify that opposite to the suggestion of some commentators I’m not looking for to ‘blame’ anybody or something for our Fund’s relative efficiency. What I’m looking for to do is clarify it in order that our buyers have a transparent understanding of what has occurred and why. A proof shouldn’t be an excuse. I ponder how these commentators or our buyers would view it if we provided no rationalization. I see three essential points at play.

1. Index Focus

The domination of returns by a small group of main ‘know-how’ shares turned so pronounced by 2023 that it gave rise to a kind of snappy descriptors that market commentators favour with the so-called Magnificent Seven: Alphabet (Google)(GOOGL), Amazon (AMZN), Apple (AAPL), Meta (Fb) (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA). This continued in 2024 after Jensen Huang, the CEO of Nvidia, made a number of public appearances at which he extolled the upcoming transformation of computing by synthetic intelligence (‘AI’), powered in fact by Nvidia’s chips. The end result was akin to firing the beginning gun in a race by which capital expenditure on semiconductor chips and knowledge facilities by the most important tech corporations — the so-called hyperscalers — spiralled upwards in an arms race matched solely by the efficiency of their shares.

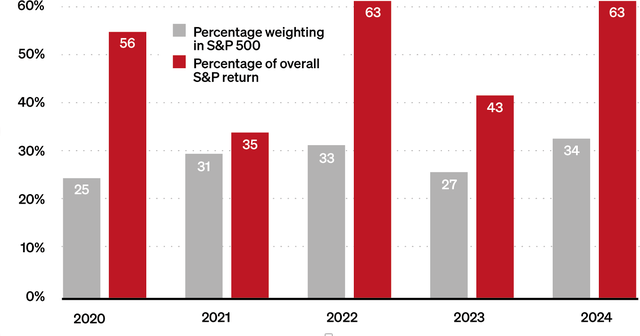

The results of this may be seen in these charts:

Focus of Efficiency From High 10 Shares in S&P 500

Supply: UBS World Funding Returns Yearbook 2025

It continued in 2025 and as a consequence, the highest ten shares had been 39% of the worth of the S&P 500 Index (‘S&P’) on the finish of 2025 and offered 50% of the overall return it delivered in USD.

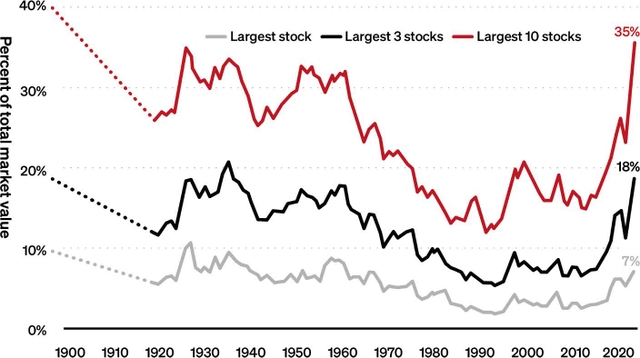

Is that this totally different to the previous?

US Market Focus Over Final 125 years

Supply: UBS World Funding Returns Yearbook 2025

This second chart exhibits that the final time the US market worth was this concentrated was in 1930. What occurred subsequent? It took till 1954 for the S&P to regain its 1930 excessive. Though that is considered prehistoric by most buyers at the moment it’s clever to do not forget that the S&P (not the NASDAQ) didn’t regain its 2000 excessive till 2007 after which promptly misplaced it once more within the Credit score Disaster till 2013. When bubbles burst they’ll trigger many misplaced years and even a long time.

It was troublesome to even carry out according to the index lately should you didn’t personal most of those shares of their market weightings, and we’d not accomplish that even when we turned satisfied that they had been all good corporations of the kind we search to spend money on, which we’re not. It will in our view signify an excessive amount of of a portfolio threat to personal all of them, simply as we might not personal all 5 of the drinks corporations we’ve in our Investible Universe even when we thought that prospects for the sector had been good. Our Fund is a portfolio, not a sectoral wager.

2. The Progress of Belongings in Index Funds

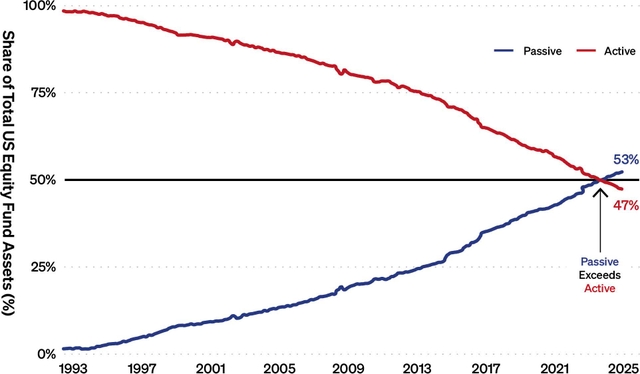

The rise of the Magnificent Seven and the AI shares additionally had a powerful tailwind from the rise in property held in index funds. In 2023 the proportion of US equities fund property held in index monitoring funds handed 50% for the primary time.

Energetic vs Passive Fund Share of US Fairness Fund Belongings

Supply: Analysis Associates, Knowledge as at thirty first Dec 2024

The monetary companies business typically doesn’t support understanding with the labels it employs. Index funds and index ETFs are sometimes labelled ‘passives’ in distinction with ‘energetic’ funds, like Fundsmith Fairness Fund, which have a fund supervisor making funding choices. The ‘passives’ principally observe the index they spend money on by holding the shares in proportion to their market worth. Removed from being passive in any usually accepted sense of the phrase, this makes them a momentum technique.

A momentum funding technique is one by which the investor buys shares that are performing strongly. In the event you redeem cash from an energetic fund like Fundsmith Fairness Fund and make investments it in an S&P 500 Index tracker fund your new fund will purchase the index shares in proportion to their market worth. At the moment about 7% of it can go into Nvidia which we don’t personal. About 35% will go into the Magnificent Seven of which we personal solely three shares — Alphabet, Meta and Microsoft. This provides added momentum to these shares we don’t personal that are a significant a part of the index.

John Bogle, the pioneer of index investing who based Vanguard, the index fund supervisor, was requested on the 2017 Berkshire Hathaway annual assembly if there was a degree of property in index funds which might distort markets and he agreed that there was, though he had no methodology of figuring out that degree. We might have already got reached it.

In 2021 the Nationwide Bureau of Financial Analysis (‘NBER’) in Cambridge, Massachusetts printed analysis entitled ‘Searching for the origins of monetary market fluctuations: the inelastic markets speculation’. You could not have heard of this as it isn’t the form of factor to take for a learn on an extended flight. Nonetheless, it has some startling revelations that are related to the present market.

It begins with the seemingly uncontroversial assertion that $1 (or $1m or $1bn) switched between both shares or bonds (or another swap) doesn’t have an effect on the intrinsic worth of both. In the event you redeem funds from an energetic fund like Fundsmith Fairness Fund to put them in an index fund it doesn’t alter the valuation of the shares we’ve to promote to fund the redemption or the shares that the index fund buys. Nonetheless, the NBER paper exhibits that in actuality such a swap has a multiplier impact of something from 3:1 to eight:1, a mean of about 5.5:1. The influx from such switches pushes up the worth of the shares bought by a mean of 5 instances the quantity invested. To say this flies within the face of elementary funding principle could be a masterly understatement.

The NBER paper attributes this to the inelasticity of demand and provide for equities. Over 50% of equities are in index funds which haven’t any discretion over what they purchase. Furthermore, some portion of the so-called energetic funds that are left are managed in a means that makes them unlikely to wager in opposition to what is occurring within the index. Other than any mandate restrictions, fund managers have lengthy realised the profession preserving nature of so-called closet indexation by which they don’t stray removed from the index weightings. Given our expertise lately, who can blame them?

The NBER analysis might in a single sense be considered a press release of the blindingly apparent affect of the rise of index funds, however what is much from apparent is the dimensions of that affect. Nor does the truth that one thing could seem apparent, as soon as it’s defined, imply that it ought to then be ignored.

It might make no elementary sense to purchase Tesla shares on a Worth Earnings Ratio (‘PE’) of 327 (which is its present score) however it’s the ninth largest firm within the S&P 500 Index by worth so not holding it’s a perilous place to take when cash is flowing into index funds.

John Bogle was proper. The growing proportion of equities held by index funds are invested with none regard to the standard or valuation of the shares purchased which produces harmful distortions.

Opposite to fashionable perception, the inventory market shouldn’t be an alternative choice to on-line casinos however slightly a mechanism for valuing corporations, elevating capital and offering liquidity. When this turns into distorted the result’s typically a significant misallocation of capital.

Sir John Templeton, who based the eponymous funding administration group, as soon as stated, ‘The 4 most harmful phrases in investing are: This time it’s totally different’. He was mentioning that there are at all times people who find themselves prepared to rationalise outbursts of funding mania however they’re at all times confirmed improper when the bubble bursts and funding fundamentals reassert themselves.

We’ve seen this earlier than, not solely within the Dotcom increase and bust, however in different examples such because the Japanese market within the late Eighties. Then we had been informed that the PE of over 50 on the Nikkei Index was okay as a result of Japanese accounting was conservative. In actual fact, the market was simply overvalued. After the following fall within the Nikkei it took till 2024 for the index to regain the height it attained in 1989.

When corporations and/or buyers are inspired by hovering share costs and valuations to consider that capital is sort of free, some disastrous funding choices observe. They appear to behave as if the price of the capital that corporations are investing is to some extent the reciprocal of their PE ratio. So, a PE of fifty equates to a price of capital of two% (100÷50). That is utter nonsense.

The price of fairness doesn’t differ inversely with the valuation and is probably finest estimated by the price of so-called risk-free capital, being the yield on long-dated authorities bonds plus what known as an fairness threat premium. It’s not a nasty place to begin when making an attempt to estimate a price of fairness capital to take a look at the long-term return on equities as it’s in impact a possibility price: what return ought to an investor count on from fairness funding over the long run? That’s what they need to demand as a price of supplying fairness by proudly owning shares — the price of fairness capital. US equities have averaged a return of about 9% p.a. over the previous century. It actually isn’t 2%.

If corporations or buyers begin making choices which deviate a lot from that assumption primarily based upon hovering share valuations the end result will likely be disastrous. In 2000 Vodafone, the UK primarily based cell phone operator which was one of many leaders within the Dotcom increase, bid for Mannesmann, the German cell operator. On the time Vodafone was on a PE of 54 and Mannesmann was on a PE of 56. That factors to a different fallacy — managements typically justify what they’re paying for property in booms and bubbles by the truth that they’re paying by issuing over-valued or extremely valued shares. Cling on a minute, what does that suggest for buyers? We will see the outcomes insofar as Vodafone’s shares peaked at a worth of 570p in 2000 when it bid for Mannesmann and they’re now buying and selling at 99p. When worth is destroyed by dangerous capital funding choices there may be at all times a reckoning.

Maybe the executives operating a few of the main AI corporations have a transparent view of the long run and may foresee that AI will produce not only a transformation in our lives and the best way we work but additionally incremental money flows such that the returns on the humongous quantities of capital they’re investing will likely be ample or higher than ample. But when not, we are able to count on Sir John Templeton’s adage to be confirmed to be proper as soon as once more, albeit perhaps after an extended interval and bigger scale of irrational exuberance than we’ve seen up to now, pushed by the momentum of index investing.

Nonetheless, even when we’re proper in diagnosing this transfer to index funds as one of many causes of our current underperformance and it’s laying the foundations of a significant funding catastrophe, I’ve no clue how or when it can finish besides to say badly.

With honest respect to the late Sir John Templeton whom I quoted earlier, I believe this time it might be totally different. Not within the sense that the Magnificent Seven/AI increase is totally different however slightly within the scale it might attain and the way lengthy it might persist. Once we had the Dotcom increase the proportion of AUM which was in index funds was below 10%. The dominance of index funds now makes the rise of those giant shares a self-fulfilling prophecy.

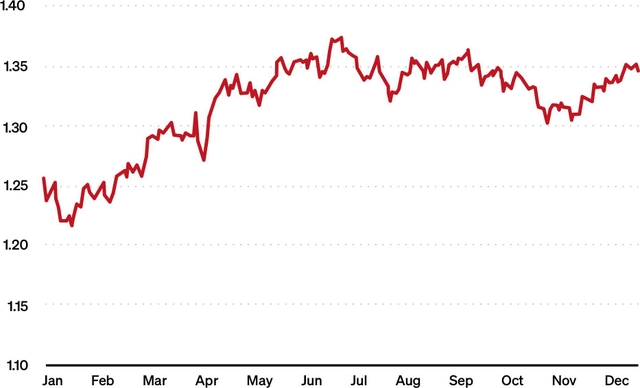

3. Greenback weak spot

Simply so as to add to the headwinds, the US greenback fell in opposition to the pound from about $1.25/GBP at the beginning of the yr to $1.35 at yr finish:

USD vs GBP Trade Charge

Supply: Bloomberg

I doubt this displays relative power of the UK financial system or satisfaction with authorities coverage. The Trump administration is clearly eager to see rates of interest decrease and to scale back the commerce deficit. Neither of those goals is appropriate with a powerful greenback.

Greenback weak spot can be seen within the worth of gold which is at a 50-year excessive of $4,319 per ounce. There may be a lot of hypothesis in regards to the causes for the power of the gold worth however to some extent I view it as an expression of weak spot within the foreign money by which gold is priced.

This impacts the GBP worth of our Fund for the reason that majority of the businesses are listed in the US and extra importantly that’s their largest single income.

I hope that each one of this may occasionally go a way in the direction of explaining what we’ve been going through when it comes to competitors from index funds and the efficiency of enormous tech corporations particularly lately with the added handicap of greenback weak spot.

These occasions have satisfied me that Tommy Docherty was an optimist. Within the week when he was fired as supervisor of Manchester United and his spouse filed for divorce he stated, ‘In life when one door closes, one other slams in your face’. I believe I understand how he felt.

Maybe a extra pertinent query is what are we going to do about it?

We might:

Begin shopping for shares in all the big corporations which dominate the indices, and/or Turn into momentum buyers who purchase shares that are performing strongly no matter their elementary deserves.

We’re not going to do both. If you’d like an index fund you should purchase one with a lot decrease prices than we or another energetic funding supervisor apply. Nor are we momentum buyers and there are higher exponents of this funding technique than us. I might simply provide one word of warning in case you are pondering of taking this strategy. Good momentum buyers in my expertise purchase shares that are going up and promote them once they begin happening. They don’t persuade themselves, for instance, that as a result of they’ve purchased Nvidia shares when they’re going up, they know what’s going to occur with AI or GPUs.

We gained’t be shopping for shares in corporations just because they’re giant and dominate the index weightings and efficiency except we change into satisfied that they’re good companies of the kind we want to personal which have long run comparatively predictable sources of progress and greater than ample returns on the capital they make investments.

While we’re going to persist with our funding technique we are going to in fact search to do it higher. We’re followers of most of the late Charlie Munger’s pronouncements however the one which finest applies right here is ‘Any yr that you do not destroy one among your best-loved concepts might be a wasted yr.’ Extra to observe.

Taking a look at particular person inventory contribution to efficiency in 2025 as ordinary I want to start out with the issues. The underside 5 detractors from the Fund’s efficiency in 2025 had been:

Supply: State Road

Novo Nordisk managed to reaffirm my perception that you must by no means say ‘Issues can’t get any worse’. The corporate has parlayed a market main place in what might be probably the most thrilling drug improvement for about three a long time right into a secondary place and has failed to stop unlawful generic competitors in its core US market.

Considered one of our mantras has been that we must always at all times spend money on companies which might be run by an fool in order that efficiency shouldn’t be closely reliant upon administration. We’ve been made painfully conscious that the vary of companies which could be run by an fool is rather more restricted than we thought and hereafter we are going to goal to be extra conscious of the affect that poor administration can have. Our expertise additionally means that after we encounter poor administration, engagement to alter it’s much less efficient than promoting the shares. In the meantime Novo Nordisk has appointed a brand new CEO and made wholesale board adjustments and the current score (a PE of 13) seems to us to expect little or no. If we didn’t already personal it I think we might ponder shopping for it as enterprise which has been depressed by a ‘glitch’, albeit a slightly giant glitch.

ADP as a supplier of payroll and HR software program has suffered from weak spot within the US jobs market. In view of the outlook for this core market we hope — with some nervousness — that the steering administration has given on future revenues is conservative. Not as a result of we depend on it, however the market does.

Church & Dwight, the buyer staples enterprise, appears to be affected by the truth that the blended fortunes of various teams of customers within the US financial system, removed from driving customers in the direction of its low cost merchandise, is as an alternative impoverishing these customers who naturally gravitate in the direction of them.

Coloplast is one other Danish medical firm — this time in units slightly than medication. A few vital acquisitions have been adopted by a lack of management on operational issues which has resulted in a poor backside line efficiency. As soon as once more, the CEO has been ejected and we await a alternative.

Maybe there’s something within the water in Denmark.

We purchased Fortinet after its shares had suffered from a fall because it got here down from the Covid associated highs of income progress when its FortiGate firewall programs had been deployed in order that we might make money working from home. Extra not too long ago it has suffered from some disappointment that it might have over-hyped the potential income from a renewal cycle.

In an age by which analysts depend on spoon fed forecasts within the type of ‘steering’ and there may be restricted liquidity because the NBER paper suggests, outcomes which fall wanting optimistic steering can produce spectacularly dangerous share worth actions.

For the yr, the highest 5 contributors to the Fund’s efficiency had been:

Supply: State Road

Alphabet makes its first look.

IDEXX, the veterinary diagnostic gear enterprise, makes its sixth look having resurrected its place from being a detractor final yr when it was affected by the ebbing of the Covid period mania for pet adoption.

Philip Morris makes its fifth look because it continues to point out the advantages of its business main transfer into reduced-risk merchandise (‘RRPs’) comparable to ‘heat-not-burn’ tobacco merchandise and its nicotine pouch enterprise.

Meta makes its fifth look on this record of prime contributors whereas Microsoft seems for the tenth time.

We proceed to use a easy three step funding technique:

Purchase good corporations Don’t overpay Do nothing

I’ll evaluation how we’re doing in opposition to every of these in flip.

As ordinary we search to offer some perception into the primary and most vital of those — whether or not we personal good corporations — by supplying you with the next desk which exhibits what Fundsmith Fairness Fund could be like if as an alternative of being a fund it was an organization and accounted for the stakes which it owns within the portfolio on a ‘look-through’ foundation, and compares this with the market, on this case the FTSE 100 and the S&P 500. This additionally exhibits you ways the portfolio has advanced over time.

Supply: Fundsmith LLP/Bloomberg.

ROCE (Return on Capital Employed), Gross Margin, Working Margin and Money Conversion are the weighted imply of the underlying corporations invested in by the Fundsmith Fairness Fund and imply for the FTSE 100 and S&P 500 Indices. The FTSE 100 and S&P 500 numbers exclude monetary shares. Curiosity Cowl is median.

2018–2019 ratios are primarily based on final reported fiscal yr accounts as of thirty first December and for 2020–25 are Trailing Twelve Months and as outlined by Bloomberg.

Money Conversion compares Free Money Move per Share with Internet Revenue per Share.

In 2025 return on capital, gross margins and working revenue margins had been all excessive and regular.

Constantly excessive returns on capital are one signal we search for when looking for corporations to spend money on. One other is a supply of progress — excessive returns are usually not a lot use if the enterprise shouldn’t be in a position to develop and deploy extra capital at these excessive charges. So how did our corporations fare in that respect in 2025? The weighted common free money circulation (the money the businesses generate after paying for every part besides the dividend, and our most popular measure) grew by 16%.

From a elementary perspective, which is what we search to deal with, we’re assured that our portfolio corporations will proceed to carry out effectively over the enterprise and market cycles. The standard of our portfolio corporations is as excessive because it has ever been and collectively they proceed to develop free money circulation faster than the historic common of the portfolio. The underlying enterprise efficiency stays our major focus. If we get that proper then our Fund will emerge with the intrinsic worth of its investments maintained or enhanced, as in the end, share costs replicate fundamentals, not the opposite means round.

Encouragingly, the typical yr of basis of our portfolio corporations on the year-end was 1919. Collectively they’re over a century previous.

The one metric which continues to lag its historic efficiency is money conversion — the diploma to which income are delivered in money. Though this recovered barely to 94% in 2025, that is nonetheless under its historic degree of round 100%. This was because of a pointy rise in capital expenditure at a small group of corporations: Alphabet, Microsoft and Meta. The tech corporations are in a race to construct capability for AI within the type of GPU chips and knowledge centres. Whether or not this arms race produces ample income and returns for the quantities expended stays an open query.

As we are able to see, our tech corporations are ramping up capital expenditure together with Amazon:

Capex For Main Tech Firms

And this desk doesn’t embody some corporations which have main capex commitments like Oracle (ORCL) which has introduced it can spend some $50 billion in 2025/6 or CoreWeave (CRWV) which is predicting round $25 billion of capex in 2026.

When commentators focus on the way forward for synthetic intelligence and whether or not there’s a bubble in AI investments they typically appear to overlook the purpose. AI might have a profound impact on our lives and employment however that doesn’t assure that funding in it can attain an ample return or that returns will gravitate to the current incumbents.

One firm which intrigues us on this respect is Apple. Relying upon your standpoint it has both been left behind within the scramble to construct Giant Language Fashions (‘LLMs’) and hyperscale to offer AI infrastructure or it has opted out of the race. Consequently, its capital expenditure in 2025 was a mere $12 billion which pales into insignificance as compared with the businesses within the desk above.

It might be making a advantage of necessity however perhaps Tim Cook dinner the CEO is engaged on an previous adage, ‘You don’t should personal a cow to promote milk’. Apple has its units and a couple of billion principally high-end customers locked into them and more and more into its companies. It appears unlikely that there will likely be a scarcity of LLMs that the hyperscalers will wish to provide Apple for iPhone customers. If that is certainly the enterprise mannequin Apple is counting on it might not bode effectively for the LLM builders and/or hyperscalers’ profitability.

The second leg of our technique is about valuation. The weighted common free money circulation (‘FCF’) yield (the free money circulation generated as a proportion of the market worth) of the portfolio on the outset of 2025 was 3.1% and ended the yr at 3.7%. The year-end FCF yield of the S&P 500 was 2.8% and MSCI World was 3.1%. Our portfolio shares have change into much more lowly valued than the S&P because the free money circulation of most of the main shares which now dominate the index has shrunk or disappeared within the face of huge capex spending on AI.

Our portfolio consists of corporations which might be basically lots higher than the typical of these within the S&P 500, and up to now we’ve defined that it’s no shock if they’re valued extra extremely than the typical S&P 500 firm. In itself this doesn’t essentially make the shares costly, any greater than a lowly score makes a inventory low-cost however they’re now considerably cheaper than the S&P. Nevertheless it additionally raises an apparent concern about what is going to occur to the market.

Turning to the third leg of our technique, which we succinctly describe as ‘Do nothing’, minimising portfolio turnover stays one among our goals and this was once more achieved with a portfolio turnover of 12.7% in the course of the interval. It’s maybe extra useful to know that we spent a complete of simply 0.008% (just below one foundation level) of the Fund’s common worth over the yr on voluntary dealing (which excludes dealing prices related to subscriptions and redemptions as these are involuntary). We bought two corporations, bought 4 and obtained a holding in Magnum Ice Cream which was spun out from Unilever. As final yr this may occasionally look like a whole lot of names for what shouldn’t be a whole lot of turnover as in some circumstances the dimensions of the holding bought or purchased was small. We’ve held three of the portfolio’s 27 corporations since inception in 2010, 10 for greater than 10 years and 16 for over 5 years.

Why is that this vital? It helps to minimise prices and minimising the prices of funding is an important contribution to reaching a passable consequence as an investor. Too typically buyers, commentators and advisers deal with, or in some circumstances obsess about, the Annual Administration Cost (‘AMC’) or the Ongoing Costs Determine (‘OCF’), which incorporates some prices over and above the AMC, that are charged to the Fund. The OCF for 2025 for the T Class Accumulation shares was 1.04%. The difficulty is that the OCF doesn’t embody an vital component of prices — the prices of dealing. When a fund supervisor offers by shopping for or promoting, the fund sometimes incurs the price of fee paid to a dealer, the bid-offer unfold on the shares dealt in and, in some circumstances, transaction taxes comparable to stamp responsibility within the UK. This will add considerably to the prices of a fund, but it isn’t included within the OCF.

We offer our personal model of this whole price together with dealing prices, which we’ve termed the Whole Value of Funding (‘TCI’). For the T Class Accumulation shares in 2025 the TCI was 1.06%, together with all prices of dealing for flows into and out of the Fund, not simply our voluntary dealing. We’re happy that our TCI is simply 0.02% (2 foundation factors) above our OCF when transaction prices are taken into consideration. Nonetheless, we might once more warning in opposition to changing into obsessive about costs to such an extent that you just lose deal with the efficiency of funds. It’s price mentioning that the efficiency of our Fund tabled in the beginning of this letter is after charging all charges which ought to absolutely be the principle focus.

We bought our stakes in Brown-Forman (BF.A) and PepsiCo (PEP) and began buying stakes in Zoetis (ZTS), EssilorLuxottica (ESLOF), Intuit (INTU) and Wolters Kluwer (WOLTF) in the course of the yr.

Brown-Forman and PepsiCo’s snack enterprise appear to us to be immediately within the crosshairs of the affect of diminished appetites from weight reduction medication. Whether or not or not our Novo Nordisk funding lastly comes good, we consider that weight reduction medication and their affect are right here to remain. As well as, the alcoholic drinks enterprise faces headwinds from the affect of Era Z’s ingesting habits (lack of) and the legalisation of hashish.

Zoetis is the main veterinary pharmaceutical firm. Other than tapping into the long run progress in pet healthcare spend, it has the benefit that multi-billion greenback gross sales blockbuster medication don’t exist in veterinary care and they also entice much less generic competitors. Zoetis’s share worth had a poor interval brought on by issues over uncomfortable side effects related to Librela, its drug for power ache from osteoarthritis (my lurcher has it). Our veterinary guide tells me she nonetheless prescribes it as the advantages outweigh the potential uncomfortable side effects.

EssilorLuxottica arose from the merger of French and Italian corporations which dominate the marketplace for eyeglasses, each frames and lenses. There’s a tailwind for this enterprise from individuals who don’t but have entry to imaginative and prescient correction. As well as, it has some fascinating improvements such because the Stellest lenses which assist forestall deterioration for youngsters with myopia and naturally the Meta AI glasses.

We beforehand bought a place we held in Intuit, the accounting and tax software program firm, after it acquired Mailchimp in 2021 as a result of we felt that Mailchimp fell outdoors its circle of competence they usually paid about 3 times the precise worth, one thing which they tried to justify by mentioning that half the consideration paid was in Intuit shares. What this implied about their valuation appeared apparent to us. For some time after we bought the shares AI hype drove the worth however latterly the poor efficiency of the Mailchimp acquisition has change into evident and mirrored within the share worth. We’ve began to rebuild a stake within the hope that the administration has realized from the debacle.

Wolters Kluwer is the chief in technical publishing utilized by professionals in well being, tax, accounting, threat & compliance and authorized. It appears to have change into seen as an AI disruption sufferer however this appears about as true because the now discredited view that Adobe and Intuit had been AI beneficiaries. This view has pushed the PE to <19x and it’s nonetheless rising at c5% p.a. with a ROIC of 18% and ROE of about 50%.

We intend to proceed holding a portfolio of excellent companies within the hope and expectation that their robust elementary returns will shine by way of into superior share worth and fund efficiency over the long run and that within the interim our fund will show comparatively immune from any shocks which come up if or when the current extraordinary market circumstances unwind.

Lastly, as soon as extra I want you a cheerful New 12 months and thanks in your continued assist for our Fund.

Yours sincerely,

Terry Smith CEO, Fundsmith LLP

Unique Put up

Editor’s Word: The abstract bullets for this text had been chosen by Looking for Alpha editors.